INSIGHT

The economic cost of prolonged political confrontation is further getting heavier whose latest victim is Pakistan’s currency that has unprecedentedly depreciated by over Rs4 in a single day in the last nine years. It all happened when the central bank decreased 3.1 percent exchange rate against a Dollar.

Many believe rupee plunged due to 14 months old unresolved Panama gate and it coincided with the appearance of Maryam Nawaz before the JIT on Wednesday last. Earlier such developments saw slowing down of major economic activities including lessening of local and foreign investment except $54 billion China Pakistan Economic Corridor (CPEC) that is otherwise expected to offer 8 percent plus GDP growth rate over a longer period of time.

Many believe rupee plunged due to 14 months old unresolved Panama gate and it coincided with the appearance of Maryam Nawaz before the JIT on Wednesday last. Earlier such developments saw slowing down of major economic activities including lessening of local and foreign investment except $54 billion China Pakistan Economic Corridor (CPEC) that is otherwise expected to offer 8 percent plus GDP growth rate over a longer period of time.

The angry Finance Minister Ishaq Dar told the media that an investigation has been ordered against those officials of the central bank who did not take notice of unparalleled deprecation of rupee. The government and the PML (N) is reportedly telling their people that it was due to JIT that has caused ripples both in the stock and currency markets.

The run on dollars and panic in both the stock and currency markets is amply suggesting that the government will sooner and not later have to go to the International Monitory Fund (IMF) for rescue as had been predicted by some government officials, independent economists as well as many active market players.

Though the Pakistani currency witnessed Rs2 improvement against dollar, the increasing political uncertainty arising out of the infamous Panama leaks scandal continues to overshadow even small achievements of the government. But then again on Thursday morning, rupee depreciated to Rs107 against dollar which shows that the market is still unpredictably creating more confusion and chaos.

Those who are in the know of fast political developments, say the expected judgment by the Supreme Court of Pakistan in the third week of this month, to be given in the light of the joint investigating report would clear the way to some extent for looking after the economy, whether by the current government or some other likely political set up.

The issue, they maintain warrants immediate cessation of hostilities between the government and the opposition parties if at all the downslide in the economy resulting from what many describe “scourge of bad politics” is to be restricted.

Foreign media is predicting that Prime Minister Nawaz Sharif’s weak position would shortly be forcing his government to knock the doors of the IMF for emergency $8 to $10 billion assistance to avoid any default situation. The State Bank’s $16 billion foreign exchange reserves are fast becoming insufficient for five weeks of imports. Other $5 billion are being maintained by the commercial banks which are incorrectly shown in the central bank account; as total reserves amount to $21 billion.

Has the falling of rupee in the inter-bank rate created a shortage of dollars or this is a deliberate attempt to hold the greenback? In both the cases it has sparked shortage of dollars in the market. Why did the central bank maintain an intriguing silence on July 5 (last Wednesday) when the rupee was sharply depreciating against the dollar?

Was the panic choice made by the central bank meant to adjust the exchange rate to help increase falling exports or help the government to achieve political goals? The finance minister chaired an emergency meeting on last Thursday with the presidents of commercial banks and other senior officials of his ministry to undo the rupee fall.

One of the reasons for slowing down of the economic activity is said to be Mr Dar’s increasing political commitments coming in the wake of the Panama leaks scandal. Why was not the IMF obliged throughout the three-year $6.2 billion Extended Fund Facility (EFF) to depreciate the rupee which it believed was 17 percent higher against the dollar? Why has the government chosen this time to remove exchange rate parity? Does it have anything to do with pleasing the IMF to seek another bailout package?

The IMF in its IV consultations with Pakistan held recently in Washington took a 190 degree turn to conclude that the country’s economy faced serious challenges and risks and that economic achievements were turning vulnerable, all of which required the planners to make serious efforts.

Those who are familiar with the working of the International Financial Institutions (IFIs) particularly the IMF, maintain that the fund officials had offered another lending programme to Pakistan after the expiry of EFF in October 2016, which was politely declined by Dar-led economic team in Dubai. And it did not go well with the IMF which later got tough especially when it held the article 1V consultations with Pakistan.

And now when foreign exchange reserves are decreasing, home remittances are falling, trade deficit is going as high as $30 billion and current account deficit reaching over $9 billion, IFIs do not seem to be in a mood to oblige except on their own conditions which may entail political arm twisting, including rolling back of the country’s prestigious nuclear programme at the behest of the United States.

Pakistan Muslim League-Nawaz (PML-N) senator Enver Baig is on record having warned in a television programme that as soon as Pakistan’s current $80 billion external debt crosses $100 billion, IMF and other IFIs would start asking for denuclearisation and that will it be a very sad day for the country.

Is it a one-off devaluation or people will have to see more such moves? “This was not our decision but that of the market and surely we did not intervene in it as we do not believe in directing the market which has its own pressures both negatives and positives,” an official of the central bank said.

He conceded that the finance ministry was unhappy over depreciation of the Pakistani currency and had called for taking urgent remedial measures which, he added, cannot be taken by the SBP and that market forces will have to decide the fate of the rupee. Nonetheless, he termed it a long awaited issue which, according to him, will on one side help increase exports and on the other side restrict imports which have doubled and reached $45 billion.

“You must not forget that the central bank does not determine market rate, therefore, we should not be expected to intervene unless something goes beyond certain basic economic fundamentals,” he said. He agreed that the market was rife with speculations and three percent increase in exchange rate was not appreciated by the ministry of finance. “But then you cannot hold the central bank responsible for it,” the official emphatically said choosing anonymity.

He expressed strong hopes that rupee devaluation will restrict falling exports and curtail rising imports, including $1 billion mobile phone imports, and added that exporters had been provided a better incentive to increase the much needed exports. “I am sure three percent rupee depreciation vindicates the central bank’s position in terms of curtaining gap between imports and exports,” he said.

But it is not all that simple as the central bank knows it fully well when to intervene in the market and when to avoid to ensure some effective exchange rate mechanism. There is no doubt that the SBP knows how to strike a balance in terms of having an effective exchange rate. Sometimes it buys dollars from the market and other times it sells to the inter-bank market; the main objective of which is to keep a balance in the supply and demand of dollars. This approach has successfully been pursued by the central bank for so long despite the fact that the IMF had been objecting on it, though privately, by repeatedly asking the government to devalue its currency.

Who does not know that exchange management remains a critical issue for vulnerable countries like Pakistan which often face a balance of payment crisis? An overvalued exchange rate invariably limits the growth of exports as domestically produced goods become uncompetitive compared to foreign goods. In our context, this is true especially against India, China, and Bangladesh exports which had been rising due to their regular devaluation of currencies.

The stability of the currency is usually measured by the spread between the inter-bank foreign exchange rate and the open market foreign exchange rate for the US Dollar. This spread is expected when the inter-bank exchange rate is not allowed to adjust to the changes in demand and supply of US dollars in the currency market.

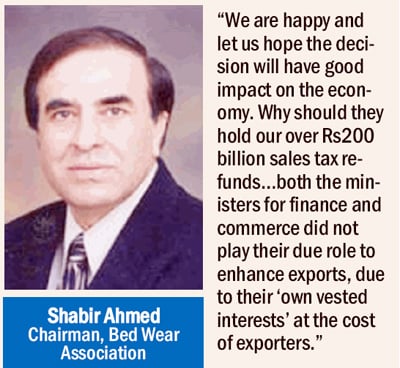

Shabir Ahmed

Chairman, Bed Wear Association

“We are happy and let us hope the decision will have good impact on the economy. Why should they hold our over Rs200 billion sales tax refunds…both the ministers for finance and commerce did not play their due role to enhance exports, due to their ‘own vested interests’ at the cost of exporters.”

It was in this backdrop it was said that the overvalued exchange rate could be counterproductive for exporters who earn their profit margins and that the government must promote exports in industries that are less sensitive to price changes. Currently, Pakistani exports are mainly limited to agricultural commodities, textiles and leather, and food products. The country’s exports faced a setback when the global prices of such products saw a downward trend in the past few years.

It was in this backdrop it was said that the overvalued exchange rate could be counterproductive for exporters who earn their profit margins and that the government must promote exports in industries that are less sensitive to price changes. Currently, Pakistani exports are mainly limited to agricultural commodities, textiles and leather, and food products. The country’s exports faced a setback when the global prices of such products saw a downward trend in the past few years.

Chairman of Pakistan Bed Wear Export Association (PBEA) Shabir Ahmed, however, has appreciated the devaluation of the currency and said the decision would go a long way to increase falling exports. At the same time, he believed, it would largely discourage undue, especially luxury imports into the country.

“We are happy and let us hope the decision will have good impact on the economy,” he said while accusing the finance minister of not helping to mitigate the suffering of the exporters. “Why should they hold our over Rs200 billion sales tax refunds”, Ahmad asked. He regretted that both the ministers for finance and commerce did not play their due role to enhance exports, what he termed due to their “own vested interests” at the cost of exporters.

Exchange rate mechanism got more importance when SBP reported the real effective exchange rate (REER) for the Pakistani rupee (base year 2010), in October to beat 124. The month-to-month change in October 2016 was 1.74 percent which was the highest since January 2015. The REER is the weighted average, adjusted for inflation of the domestic currency relative to the currency of major trading partners. The increasing REER widens the trade deficit as Pakistani consumers are likely to prefer the imported verities and the exporters face a fall in their competitiveness against foreign competitors.

The writer is a senior journalist based in Islamabad