INSIGHT

Finance minister Ishaq Dar along with his economic team concluded Article IV annual consultations with the International Monitory Fund (IMF) in Dubai last week. They were told that if the intensifying challenges relating to fiscal, external, and energy sectors were not tackled “the hard- won stability gains in the period ahead could be affected”.

These consultations were held afresh after the expiry of the three year $6.6 billion Extended Fund Facility (EFF) in September last year. The IMF mission led by Harald Finger called for strong efforts with respect to fiscal consolidation and the implementation of key structural reforms, and vigilance in managing the country’s external position.

The Fund officials also indirectly asked the Pakistani team to devalue Pak currency to achieve greater exchange stability with a view to increase falling exports. The objective, they believed, is to address the issue of widening trade deficit as well as strengthening economic stability to absorb medium-term China-Pakistan Economic Corridor (CPEC)-related and other capital outflows.

As is said in the diplomatic world, selection of words is very important to discuss or address any important issue. Same is said about the International Financial Institutions (IFIs) especially the IMF whose officials prepare their press statements very carefully and diplomatically after the conclusion of talks with any member state.

The Dubai statement begins by praising the performance of the economy by saying that after three years of reforms, Pakistan has strengthened its macro-economic resilience and economic outlook, providing an opportunity to build on recent progress with structural reforms and set the economy on a higher growth path.

But then it states that stagnant exports are weighing on growth prospects as the current account deficit is feared to reach close to 2.9 percent of Gross Domestic Product (GDP) during the current financial year.

In the remaining statement, the fund officials sufficiently cautioned the government to address serious issues and economic challenges which if not addressed, experts and independent economists believe could force the country soon to return to the Washington-based lending agency for emergency assistance.

Throughout 2013 election campaign, the ruling Pakistan Muslim League-Nawaz (PML-N), particularly Mr Dar had been rejecting any idea of going to the IMF for emergency lending to avoid the default situation. But subsequently, he went into negotiations with the IMF immediately after taking the charge of the ministry of finance to seek a bailout package.

Later, he defended his decision by saying that he was forced to go to the IMF due to the reckless borrowing made by the previous Pakistan Peoples’ Party (PPP) government, and that he never knew that the economic situation was so bad.

IMF’s lending programme worth $11 billion plus to the PPP government was suspended half way through for not implementing the hard conditions, but by that time $7 billion were disbursed. The PML-N government on the contrary successfully ended the IMF programme, though in the process it borrowed an unprecedented amount of $20.5 billion foreign loans in four years. The government negotiated $36 billion foreign loans, but actually, loans worth $34 billion were contracted and $20.5 billion were finally disbursed.

Now when the pressure on foreign exchange reserves have started building, fears are being expressed about another lending programme to be sought from the IMF for which its officials are believed to have started preparing grounds by saying that the government needs to meet important challenges to consolidate the gains obtained during the last four years.

Important question is does the country require a balance of payment support from the IMF to avoid yet another full blown financial crisis? Why would such a situation arise when the government is claiming it has successfully restored macro-economic stability and reduced vulnerabilities?

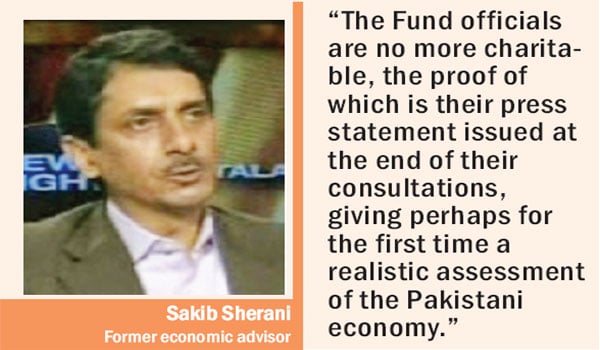

“The current economic situation sufficiently tells us that all is not well on the external front and that there is no escape from going back to the IMF for emergency lending,” said former economic advisor to the ministry of finance, Sakib Sherani.

He said by 2018, the new elected government, if not the caretaker government, will have to knock the doors of the IMF considering the fast depleting foreign exchange reserves now standing close to $22 billion. “The Fund officials are no more charitable, the proof of which is their press statement issued at the end of their consultations, giving perhaps for the first time a realistic assessment of the Pakistani economy,” the renowned economist said.

He said by 2018, the new elected government, if not the caretaker government, will have to knock the doors of the IMF considering the fast depleting foreign exchange reserves now standing close to $22 billion. “The Fund officials are no more charitable, the proof of which is their press statement issued at the end of their consultations, giving perhaps for the first time a realistic assessment of the Pakistani economy,” the renowned economist said.

Sherani was of the view that the IMF used to take into account political considerations to offer the lending programme to Pakistan. That was why it extended wavier after waiver to Pakistan, thus compromising on its own conditions. “But now the situation has changed as Pakistan is out of the programme and we will see a shift in the IMF polices that it pursued till 2106,” he said, and added that fund officials would get tough in their assessments and policies till 2108 when the new government would have no option but to seek financial assistance on tough terms.

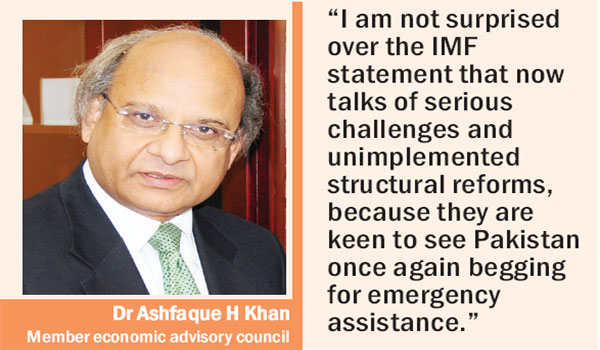

Former special secretary and director general debt office Dr Ashfaque H Khan also expressed his concern over the current state of the economy by holding the IMF responsible, whose officials, he said, had been giving a clean bill of health to the economy on flimsy grounds. “I have no doubt in my mind that the IMF remained partner in crime as it always approved manipulated statistics prepared by the officials of the ministry of finance and other departments.”

However, he wondered why this time, after the conclusion of talks in Dubai, the IMF issued some balanced and realistic assessment of the economy. “This modestly suggests that fund officials are preparing for themselves to once again trap Pakistan for new emergency lending on harsher conditions.”

He said he did not have doubts that the unravelling of the Pakistani economy has begun as the fragility of outcomes of the IMF programme were fast becoming evident. Dr Khan regretted that the IMF programme did not end up reducing economic vulnerabilities as the key macro-economic aggregates were inflated during the programme in order to show better performance of the economy.

Major economic indicators, including agriculture, large scale manufacturing, fiscal deficit, tax collection, employment, exports, home remittances, foreign direct investment (FDI), and debt had been showing negative trends, exposing the tall claims of the government.

“I am not surprised over the IMF statement that now talks of serious challenges and unimplemented structural reforms, because they are keen to see Pakistan once again begging for emergency assistance,” the distinguished economist said.

Two issues – agriculture and large scale manufacturing – remained critically important that are becoming a subject of hot topics in all the official and unofficial quarters for the last many months. The IMF too, perhaps for the first time has expressed its concern over these two issues and called upon the government to improve their performance.

Interestingly, like other international institutions and publications, IMF also sees China-Pakistan Economic Corridor (CPEC) as a gigantic project that is attracting investment and will ultimately help with achieving six percent plus GDP growth rate in near future. CPEC, a game changer, which originally amounted to $46 billion, has now been stretched to $52 billion. The CPEC is expected to help bring in the much needed foreign direct investment (FDI) which otherwise has continued to stagnate at close to $1 billion annually, compared to $5.5 billion of 2007-08.

Interestingly, like other international institutions and publications, IMF also sees China-Pakistan Economic Corridor (CPEC) as a gigantic project that is attracting investment and will ultimately help with achieving six percent plus GDP growth rate in near future. CPEC, a game changer, which originally amounted to $46 billion, has now been stretched to $52 billion. The CPEC is expected to help bring in the much needed foreign direct investment (FDI) which otherwise has continued to stagnate at close to $1 billion annually, compared to $5.5 billion of 2007-08.

Pakistan has been advised by the IMF to maintain reform momentum to achieve broader economic objectives and that continued efforts are required on this behalf.

How can Pakistan stay the course and achieve higher growth trajectory is a question often being posed to top officials. However, no plausible answer is received because of their inability, if not a failure, in implementing the structural reforms programme, particularly in the revenue and energy sectors.

Fiscal deficit – the mother of all economic ills – continues to widen, which is going to end up at more than 4.1 percent of GDP against the target of 3.8 percent set for 2016-17. The finance minister for the first time has admitted that revenue collection is facing Rs100 billion shortfalls; but he held low international oil prices responsible for this.

If the trend continues, and urgent measures are not taken, the revenue shortfall is going to end up between $250 to Rs275 billion by June this year. Revenue growth did not exceed nine percent during the first eight months of 2016-17, and one does not see the projected over 20 percent increase in it.

It all happened, when as opposed to the retirement of Rs410.6 billion, the government’s borrowing to finance the fiscal deficit from the central bank re-emerged with vengeance. This happened soon after the completion of the IMF programme, which used to somewhat necessitate it for the officials of the ministry of finance and the Federal Bureau of Revenue (FBR) to hold back on the borrowing from the SBP. The government borrowed Rs847.4 billion from the State Bank of Pakistan to finance its fiscal deficit during the period July 1, 2016 to January 13, 2017 – a turnaround of Rs1,258 billion.

At the end of the day, Pakistan needs 10 percent GDP growth rate over a 30 year period, and this requires an effective fiscal policy aimed at generating enough resources, which are not currently available due to less than 10 percent tax-to-GDP ratio. It has to be 12.5 percent during the medium term and 14 percent plus in the long term and it could only be done when all citizens pay their taxes. For this, documentation of the economy is a prerequisite to bridge the existing over Rs1 trillion gap in income and expenditure so as to make available additional resources for the state to adequately look after its people.

The writer is a senior journalist based in Islamabad