INSIGHT

TThe central bank is considering a number of alternatives to stabilise the existing exchange rate policy aimed at increasing exports and preventing unnecessary imports that are causing $1 billion current account deficit every month. The issue got compounded due to $2 billion sharp decline in foreign exchange reserves witnessed just in three months.

While the exporters’ community is relentlessly calling for depreciating the rupee against the dollar to increase falling exports, the ministry of finance and the State Bank of Pakistan (SBP) remain focused on leaving the issue on market forces to avoid any unnecessary turmoil.

While the exporters’ community is relentlessly calling for depreciating the rupee against the dollar to increase falling exports, the ministry of finance and the State Bank of Pakistan (SBP) remain focused on leaving the issue on market forces to avoid any unnecessary turmoil.

However, the increasing trade gap between exports and imports is believed to have forced the officials of the central bank to find some solution by greatly facilitating exporters through additional loans, more fiscal incentives, and if necessary amending the current exchange rate policy.

The widening gap between inter-bank rate and market rate is a “serious concern” of the officials of the ministry of finance and the SBP, but they are preventing to “intervene” in the market due to the pressures of the World Bank, International Monitory Fund (IMF) and the Asian Development Bank (ADB).

Independent economists and exporters are urging the government to arrest falling exports by depreciating the country’s currency, as had been regularly done by China, Bangladesh, India, Turkey, and Vietnam. China prefers to depreciate its currency on an as and when required-basis, despite having over $3 trillion in foreign exchange reserves.

Pakistan received a setback when its exports, mostly cotton yarn, declined to China, despite a free trade agreement (FTA) between the two countries. India and Vietnam have grabbed Islamabad’s share by offering undercut prices and providing a variety of products different from the ones produced by Pakistani textiles.

Exports have declined by 30 percent, and even the generalised system of preference (GSP) status offered by the European Union (EU) back in 2014, did not help after initially ensuring $1 billion additional export to its member states. Most critics say that the Pakistani industry has become non-competitive as the government created liquidity crunch by stopping sales tax refunds to exporters. This led to increase in the cost of production and exporters are now left with no option but to export their products on higher prices. It is also said commercial attachés in Pakistani embassies abroad were not making efforts to help increase exports by suggesting anything to the government or the exporters’ community. Resultantly, no new foreign markets have been explored. The other issues hurting exports are lack of value-addition and product diversification.

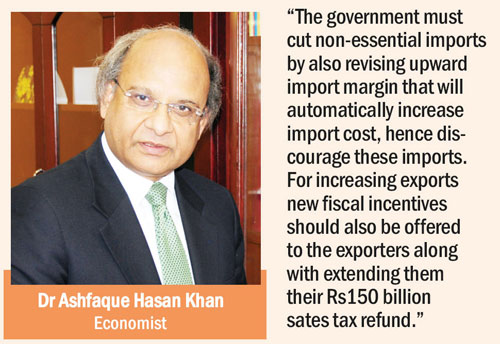

Renowned economist Dr Ashfaque Hasan Khan, who is the dean and principal of Social Sciences at National University of Science and Technology (NUST), termed the recent export package being offered by the government as an incentive “insufficient to halt falling exports”. He was of the view that the mere four to seven percent export package needed to be stretched to 20 percent to help achieve the desired results. “The government must offer rebates on various export products,” Dr Khan said, regretting that Bangladesh’s exports have risen to $34 billion and Pakistan was struggling to manage $20 billion annually.

There had been enormous increase in imports during the last three months, amounting to $600 million, he said, and added that due to speculations, people were opening letters of credit (LCs), which was also one of the reasons for increase in open market rate of the rupee.

There had been enormous increase in imports during the last three months, amounting to $600 million, he said, and added that due to speculations, people were opening letters of credit (LCs), which was also one of the reasons for increase in open market rate of the rupee.

He said, he had predicted on November 12 last year that trade deficit, now standing at $4.7 billion, would reach $7 billion by the end of the current financial year. Likewise foreign debt would touch an all- time high $110 billion in 2020 from the current $73 billion. Exports, he said, would not increase without improving the growth in large scale manufacturing (LSM) which was hovering between 2.5 percent to three percent, not enough to produce sufficient goods for exports. “If the price of our goods is more than those of regional countries, how could there be increase in our exports,” Dr Khan asked, and added that as long as the exchange rate remained overvalued, there was no scope for increasing the country’s exports.

“The government must cut non-essential imports by also revising upward import margin that will automatically increase import cost, hence discourage these imports,” Dr Khan said. “For increasing exports new fiscal incentives should also be offered to the exporters along with extending them their Rs150 billion sates tax refund,” he added. Reserves and home remittances, Dr Khan said, were declining which was not a good omen.

State Bank of Pakistan (SBP) governor Ashraf Mehmood Wathra admitted that imports were on the rise compared to exports, but then hastened to add, “Most of these imports are CPEC-related due to which current account deficit has increased to over $4 billion.”

Another reason, he said, was some decline in home remittances and closing of US coalition Support Fund (CSF) due to which the current account deficit increased during the first seven months of 2016-17 compared to the same period last year.

He did not think that exchange rate policy needed to be urgently reviewed in order to enhance failing exports. “We have left the issue of exchange rate on market forces and have no plans to intervene in that,” the central bank governor said.

The State Bank, he pointed out, did not want to unnecessarily buy dollars from the market to build up reserves. “Our exchange rate policy should not be tightly controlled and has to be market based,” he said, hoping that some more fiscal incentives, rebates, and reduction in taxes could be considered in the next budget.

Nonetheless, the central bank governor called upon the exporters to benefit from the liberal loaning policy at three percent interest rate to enhance their exports. “We have already cut the policy rate and we do not have any choice except to ensure a level playing field for all the market players, especially the exporters,” Wathra said. Imports exceeded exports due to a number of reasons, including tough competition among the countries, he added.

Speaking of the international reserves buffer, the central bank’s governor said the reserves buffer had been rebuilt to over $23 billion and was seeing a slight reduction because of making a few repayments. “I do admit that there is some reduction in home remittances, but I am hopeful that the government would meet its $20 billion target set for the current financial year.”

Speaking of the international reserves buffer, the central bank’s governor said the reserves buffer had been rebuilt to over $23 billion and was seeing a slight reduction because of making a few repayments. “I do admit that there is some reduction in home remittances, but I am hopeful that the government would meet its $20 billion target set for the current financial year.”

Generally, it is said the government kept introducing additional taxes every now and then to meet the IMF conditions relating to $6.2 billion three years Extended Fund Facility (EFF) programme.

Exports are driven by the manufacturing capacity, which needs to be enhanced. The textile sector is one of the biggest industries which unfortunately continue to suffer from subdued demand in the European market in spite of the GSP plus status, with local manufacturers losing their share to competitors from mainly India and Vietnam. And with loss of market share comes closure of capacity and loss of employment.

Exporters’ claim of sales tax refunds is no doubt a major reason behind their poor performance, along with the country’s exchange rate which they lament as overvalued, and demand lowering to help increase yawning exports.

Pakistan’s chief competitors for textile exports have been devaluing their currencies in light of a falling euro over the last few years. Pakistan on the other hand has kept its currency overvalued. The real effective exchange rate is Rs120 while the official exchange rate is Rs104.8 against the dollar. This has played havoc with exports which are commodity based and low value-added in nature. Moreover, imports have become cheaper, thus widening the balance of payment gap and frittering away the advantage of low oil and commodity prices that provided $6-7 billion annually to Pakistan.

Officials of the ministry of finance and the central bank had been saying that if the rupee was depreciated, it might contribute a maximum of $1 billion additional exports, but in return, there would be a huge burden of increasing foreign debt.

Discount rate today stands at a 43 year low. High interest rates have kept loan to deposit ratio below 50 percent over the last few years, depriving the industry of valuable credit. While credit off-take has started to pick up gradually, it is yet to gather momentum.

Since foreign direct investment (FDI) continues to decline, it is becoming a problem, and the prerequisite is security and stability. Also a ten months long controversy over Panama gate scandal prevented foreign investors to come to this part of the world for making investment. FDI is one of the major components that play an important role in achieving a better gross domestic product (GDP) growth rate.

During the first seven months of 2016-17, 10 percent increase in FDI was witnessed which was primarily due to $500 million new investment in Engro company. This FDI has averaged less than $1 billion during the last eight years which included five years of Pakistan Peoples’ Party (PPP) rule and three years of the current Pakistan Muslim League-Nawaz (PML-N) government compared to $5.5 billion of 2007-08.

Pakistan had inherited an agrarian economy and as such succeeded significantly to feed 200 million people. But the resistance by successive governments to implement fundamental structural reforms did not help to climb the ladder of economic evolution aimed at accelerating the much needed growth.

Issues relating to external sector, including failure in removing increasing gap between imports and exports coupled with reduced FDI and now home remittances are turning out to be a serious issue. The way reserves have started depleting it is feared that the new government as a result of 2018 election will have to go back to the IMF for emergency lending that might not be without political conditions.

In this regard PML-N Senator Anwar Baig is on record having said in one of his television shows that as soon as Pakistan’s foreign debt crossed $100 billion mark, IMF would set conditions for a new loan, at the behest of the United States, to wind up the country’s prestigious nuclear programme.

The writer is a senior journalist based in Islamabad