INSIGHT

The government is struggling to improve the much needed macroeconomic fundamentals and the task is getting harder following the negative growth registered in Large Scale Manufacturing (LSM), bringing more problems to the fast collapsing export sector.

The months of November, December of last year and January and February of 2016 have witnessed five percent growth in LSM, but then from March onward it went negative, making the job of the government difficult to achieve 5.7 GDP growth rate in 2016/17.

The months of November, December of last year and January and February of 2016 have witnessed five percent growth in LSM, but then from March onward it went negative, making the job of the government difficult to achieve 5.7 GDP growth rate in 2016/17.

In July this year, 2.6 percent growth in LSM was registered which too is being seen with scepticism and the official planners particularly those sitting in the Bureau of Statistics are being blamed for manipulating economic figures .They are often accused of getting involved in figure fudging. The important question is what went wrong July onwards.

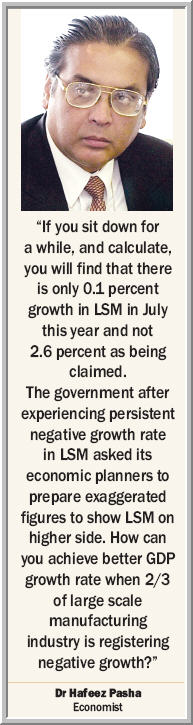

“If you sit down for a while and calculate you will find that there is only 0.1 percent growth in LSM in July this year and not 2.6 percent as being claimed,” the renowned economist Dr Hafeez Pasha said.

He said the government after experiencing persistent negative growth rate in LSM asked its economic planners to prepare exaggerated figures to show LSM on higher side. “How can you achieve better GDP growth rate when 2/3 of large scale manufacturing industry is registering negative growth,” Dr Pasha said, adding that out of 12 industrial groups, seven, including agriculture, textiles, fertiliser, chemicals, automobiles, and leather sectors went negative, posing a serious question about any real turnaround in the economy.

Fertiliser, one of the important sectors has collapsed in July this year and its production drastically came down despite reduction in prices. The growth in automobile sector had gone negative due to end of the billions of rupees “Rozgar” scheme, under which thousands of vehicles were provided to the people in Punjab.

Then the tractor sector registered 24 percent negative growth because the farmers did not have enough money to buy tractors despite reduction in interest rate attached to the borrowing.

Since 2018 elections are approaching fast, just relying on China Pakistan Economic Corridor (CPEC), the government is facing an uphill task to visibly improve broad economic indicators.

“I am afraid the PML-N government will face a similar situation the BJP government faced on their ‘shining India’ slogan of 2004 election, the party was defeated as Indian people did not buy that rhetoric,” said a former senior official of the ministry of finance. He advised the government to come out with transparent economic figures to win the next election. “People of Pakistan are wise enough to differentiate between the good and bad and therefore, cannot be fooled.”

The most hit sector is textiles which is facing serious liquidity problem, especially due to the withholding of over Rs200 billion sales tax refunds by the FBR. The matter compounded after the government imposed what many believe “senseless taxation” on different products with rates ranging from 17 to 50 percent.

The textile sector further faced a setback when the government levied five percent gas infrastructure development cess on all exports. The exchange rate being maintained by the central bank is another issue that is causing problems in increasing exports.

Critics say that fiscal deficit has reduced not because the current expenditure has come down but because of tax increases and by asking the provinces to show surpluses and by deliberately ignoring statistical discrepancies. The government, however, continues to claim that fiscal deficit has come down and that revenues have gone up so as to make available more development spending.

People, nonetheless, do ask why is the revenue not being increased substantially by enlarging the tax base and why is the government just relying on indirect taxes which account for 70 percent of the total. The issue of withholding tax is further complicating the matter and forcing the independent economists to say that so-called economic stability is not sustainable.

Ever since the present government took over, it has had many windfall gains, including all time low international oil prices – coming down from over $140 to $30 a barrel. Saudi Arabia had extended $1.5 billion gift that greatly helped the government, besides negative dollar rate was another favour to the rulers.

However, the government and some international agencies, supported by the IMF maintain that Pakistan’s economy is fairly poised for a revival of growth in 2016 after 2008 when former President General Musharraf left and the PPP government took over. These five years were termed by the central bank as low growth and high inflation period, coupled with acute power crisis across Pakistan. The State Bank of Pakistan maintained that these factors had constrained fiscal situation and culminated on low foreign exchange reserves ($600 million) at that time. And the tide began to change in 2015 with foreign exchange reserves reaching all time high (over $23 billion) though they contained borrowed money including record $12 billion by the PML-N government alone.

Critics claim that year 2018 will be very important, as on one hand elections are scheduled and on the other hand the new government will have little option to avoid another IMF bailout package. According to Dr Hafiz Pasha, external debt that now stands at $70 billion will reach $90 billion in the next two years (2019-20).

Critics claim that year 2018 will be very important, as on one hand elections are scheduled and on the other hand the new government will have little option to avoid another IMF bailout package. According to Dr Hafiz Pasha, external debt that now stands at $70 billion will reach $90 billion in the next two years (2019-20).

Power sector reforms are still not being adequately implemented and privatisation process has stalled after the proposed controversial disinvestment of Oil and Gas Development Corporation Limited (OGDCL) and the Pakistan International Airlines (PIA). In all this, major Public sector utilities are depriving the national exchequer by Rs600 billion annually. In the absence of reforms, the Federal Board of Revenue (FBR) is reportedly losing over Rs1,000 billion annual revenue, while corruption amounting to Rs12 billion is taking place daily in the country.

Bad governance is another scourge that is ruing institutions making the mockery of any political and economic stability. Lack of transparency particularly in the award of billions of rupees contracts is yet another serious issue which is hitting the national kitty, but allegedly helping the rulers and the bureaucracy to make money in the name of commission.

The avenues of major domestic and foreign earnings are fast diminishing, forcing the rulers to rely on external borrowing. Pakistan’s export earning is decreasing and the dream of achieving $30 billion annual target does not seem to be achievable as exports have come down to less than $25 billion. Foreign remittances are facing stagnation, though the central bank believes the government will meet its $20 billion annual target.

The increasing debt burden is shaking the very foundations of the country’s fragile fiscal base with rulers playing with fire by not fixing the issue. They, rather ruthlessly indulge in both domestic and external borrowing that increases the debt burden. Today Pakistan’s total debt and liabilities have crossed Rs22 trillion compared to Rs19.8 trillion in June 2015.

This happened because of gross fiscal management, incompetence and the collusion of the rulers, particularly those of the political spectrum. Total debt and liabilities just stood at Rs6.1 trillion in June 2008 and kept increasing at a phenomenal pace. Undoubtedly the PPP and now the PML -N are responsible for mercilessly acquiring loans without realising that eventually somebody has to pay them back along with interest.

PML-N Senator Anwar Baig has said on record that once external loans cross $100 billion mark, International Financial Institutions (IFIs) will start put a condition to roll back the country’s nuclear programme to offer new loans.

All said and done, how can one claim any macroeconomic stability and fiscal consolidation when exports are down, revenue is decreasing, foreign investment is at its lowest, manufacturing sector is on a negative growth trajectory, GDP is stagnant, current account deficit widening, while agriculture, which is 23 percent of the GDP, is in serious crisis.

The writer is a senior journalist based in Islamabad