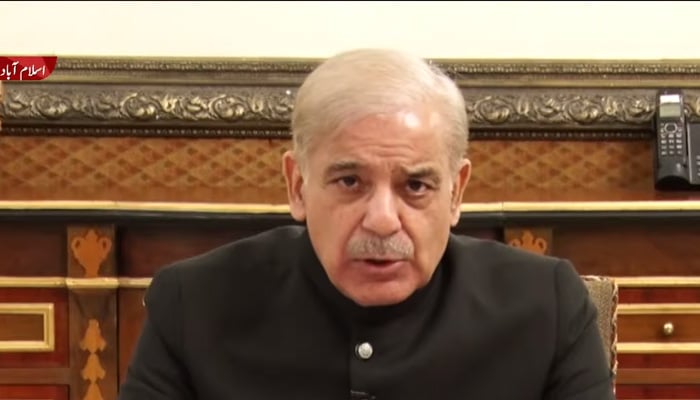

PM Shahbaz Sharif announces 10% super tax on big industries

The economy, which was at the brink of bankruptcy due to delaying tactics of the PTI government, has now been saved: PM

ISLAMABAD: Prime Minister Shahbaz Sharif on Friday said that the government has decided to impose a 10% super tax on large-scale manufacturers including oil, fertiliser, steel , sugar, automobile and textile.

The premier made the announcement after chairing a meeting of his economic team during which important decisions were taken related to budget 2022-23.

In a televised address, the prime minister said that he wants to take the nation into confidence over the government's measures to stabilise the economy.

The PM said that the decisions, taken by the government, aimed at providing relief to the people due to record inflation and reviving the dwindling economy which was shattered due to the "incompetency and corruption" of the PTI government.

The premier said that he is using the word corruption because he knows that the previous government was "involved in corruption".

“The economy, which was at the brink of bankruptcy due to delaying tactics of the PTI government, has now been saved and will come out of the shadows and move towards a growth trajectory.”

He said that the government is taking these measures at the cost of their politics, adding that they had two options and decided to save the country.

The prime minister urged the affluent sections of the society to come forward and share the burden.

He said that this is the first budget in which the government has provided an “economic vision”, warning the nation of difficult times ahead.

Announcing the imposition of a 10% super tax on cement, steel, sugar, oil and gas, fertiliser, banking, textile, chemical, beverage, and automobile industries, he said it has been done to save the common man from taxes.

“1% tax has been imposed on those earning over Rs150 million, 2% on those earning over Rs200, 3% on those earning over Rs250 million and 4% on those earning over Rs300 million,” he added.

PM Shahbaz Sharif said he had formed teams to boost tax collection with the help of organs of state institutions and through digital means.

He mentioned that 60% of the formal sector was paying taxes, however, the rest of the 40% economy needed to be brought into the tax net.

He said the collected tax would be diverted towards the projects of health, education, skilled training and information technology.

For the first time in the country’s history, he said, a budget has been presented to provide relief to the common man, orphans, widows and the poor.

The prime minister hoped that with hard work and faith in Allah Almighty, things would ease up.

He expressed confidence that the measures would take Pakistan forward on the path of prosperity, progress and economic stability.

He mentioned the support of the leaders of allied parties in standing shoulder to shoulder with the government.

He said merit, honesty, integrity and upholding the right of the downtrodden were the hallmark of his government.

‘Super tax will reverse industrialisation’

Taking to Twitter after the announcement, former finance minister and PTI leader Hammad Azhar said the super tax will end up further squeezing the formal sector of the economy.

“This means taxing the already taxed even more. The economy is nosediving and such a measure at this time will reverse the industrialisation momentum that PTI generated.”

Azhar said the industry is already facing crippling costs due to rising prices of commodities and energy and this super tax will be priced in their balance sheets and passed on to the customers in many cases.

“Means even higher prices for the public.”

-

Bitcoin plummets toward $60,000 as investors dump risky bets

-

Bitcoin crashes below $63K as regulatory pressure and market fears grow

-

Bitwise Crypto Industry innovators ETF: What investors should do in 2026?

-

Nintendo shares slide again as momentum fears grow

-

Gold, silver prices fallen sharply; What’s driving the drop?

-

Gold’s record climb: Experts question if its safety is ‘overstated’

-

Dubai unveils plans to construct street built with real gold

-

Netflix slams Paramount’s bid: 'Doesn't pass sniff test’ as Warner battle escalates