Data of major Pakistani banks hacked: FIA official

According to FIA Cyber Crimes Director retired Capt Mohammad Shoaib, the banks have not shared the details with the authorities, however, the investigations conducted by the agency confirmed the incidents of data theft.

ISLAMABAD: In an explosive disclosure, an official of Federal Investigation Agency has said that the data of major Pakistani banks have been hacked.

SBP instructs banks after ‘cyber attack’ on Bank Islami network

According to FIA Cyber Crimes Director (retd) Capt Mohammad Shoaib, the banks have not shared the details with the authorities, however, the investigations conducted by the agency confirmed the incidents of data theft of 'almost all' banks.

Six Pakistani banks suspend debit cards use abroad

Over 100 cases have been registered and the investigations are underway, he added. The FIA has also convened a meeting of banks' chiefs in this regard, Capt Shoaib told Geo News.

The official said that the hacking operation was executed from outside Pakistan. He, however, did not disclose names of the banks affected.

A separate report in Daily Jang today revealed that the ATM fraud scam has targeted hundreds of account holders and in Khyber Pakhtunkhwa only more than 200 people lost millions of rupees from their accounts.

Former chief scientist of Khan Research Laboratories, Dr Yousuf Khilji, in an application to the Chief Justice Mian Saqib Nisar on Monday has claimed that someone had fraudulently withdrawn Rs3m from his account within 17 hours.

At least six Pakistani banks suspended usage of their debit cards outside the country after BankIslami suffered a cyber attack late last month that siphoned off Rs2.6 million to the dismay of its unsuspecting consumers, people in the know told The News on Saturday.

They said six banks have so far stopped the facility of debit cards in overseas markets.

Abid Qamar, chief spokesman of the State Bank of Pakistan (SBP) told the newspaper that banks took various measures to protect their information technology systems from cyber attack following the central bank’s instructions.

“It has come to our notice that few banks have even withdrawn the facility of cards being used outside Pakistan,” Qamar said. “Some are (however) allowing this facility upon instructions of their customers only.”

On October 29, the central bank asked commercial banks to ensure safety of their payment cards from security breach after fraudulent overseas transactions, using BankIslami’s debit cards, were unearthed.

While BankIslami claimed that all monies – Rs2.6 million (approximately $19,500) withdrawn from the bank accounts, using its cards, have been credited to the accounts of customers, an international payment scheme put the transactions at around six million dollars.

Cyber attacks

Bankers said cyber security is the biggest risk to the financial system across the world as well in Pakistan.

“Banks are investing less in their cyber security systems,” a banker said, requesting anonymity. “They need to invest more to ensure they are resilient to cyber threats… and comply with the set of rules for coping with cyber attacks.”

Dark web

A Moscow-based anti-fraud firm the Group IB said nine Pakistani banks, including BankIslami, Habib Bank, JS Bank, Faysal Bank, Soneri Bank, Bank of Punjab, Bank Alfalah, Silkbank, and MCB Bank witnessed abnormal transactions.

The information security firm didn’t mention the affected transactions of the banks, but in a report last month it said BankIslami became victim of cybercrime attack after detecting abnormal transactions on one of its international payment card schemes.

The Group IB, citing the SBP, said compromised cards of BankIslami were cashed out via automated-teller machine and point-of-sale in different countries, including USA and Russia.

The Group IB said it is very rare that Pakistani cards come on sale at the online underground markets.

“An interesting fact is that cards from this region are very rare on the card shops, in the past six months it is the only one big sale of Pakistan cards,” the global leading computer forensic firm said in a flash note.

There were also 849 cards, which belonged to banks from other countries and 914 dumps of undefined banks, on sale at a cardshop, Jokerstash.

“Taking into account the facts that this base appeared on the cardshop right before detection of fraud activity in transactions of Bankislami and that it is the only big case involving Pakistani cards, most likely this sale is related to mentioned cybercrime attack,” the Group IB added.

“It is probable that the cards were compromised before 26 October, and then part of them were used by the cybercrime group to cash out via the international payments network and other cards were sold to Jokerstash cardshop.”

-

Poll reveals majority of Americans' views on Bad Bunny

-

Man convicted after DNA links him to 20-year-old rape case

-

California cop accused of using bogus 911 calls to reach ex-partner

-

'Elderly' nanny arrested by ICE outside employer's home, freed after judge's order

-

key details from Germany's multimillion-euro heist revealed

-

Uber enters seven new European markets in major food-delivery expansion

-

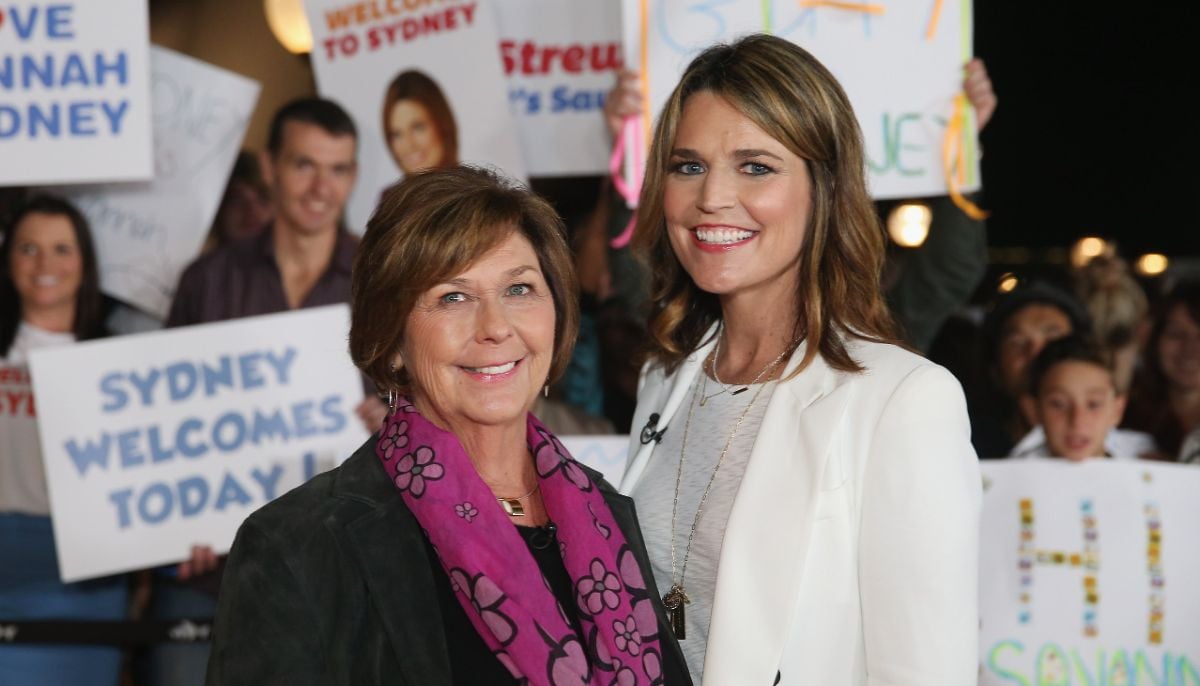

Search for Savannah Guthrie’s abducted mom enters unthinkable phase

-

Barack Obama addresses UFO mystery: Aliens are ‘real’ but debunks Area 51 conspiracy theories