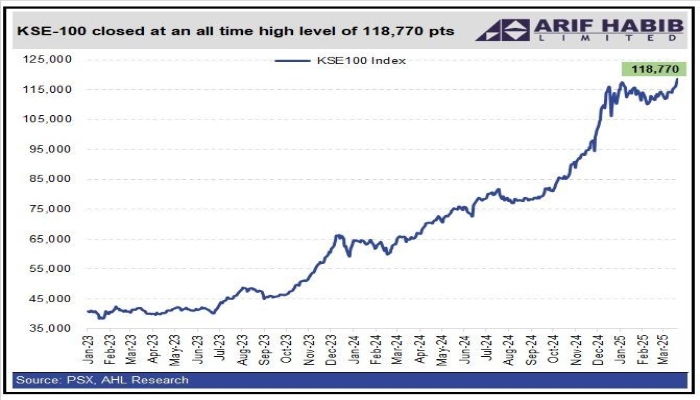

Bullish streak continues as PSX crosses 119,000 mark

KSE-100 Index gains 795.75 points, or 0.67%, to close at 118,769.77,

The capital market continued its record-breaking rally on Thursday, closing at an all-time high as investor optimism surged over progress in economic reforms and the government’s negotiations with the International Monetary Fund (IMF).

The rally was further amplified by discussions on the privatisation of state-owned enterprises (SOEs) and mounting anticipation of a reduction in industrial power tariffs.

The Pakistan Stock Exchange's (PSX) benchmark KSE-100 Index gained 795.75 points, or 0.67%, to close at 118,769.77, extending the bullish momentum that has dominated the market in recent sessions. The index reached an intraday high of 119,421.81, while the lowest level recorded stood at 118,444.03.

Prime Minister Shehbaz Sharif expressed satisfaction over the PSX reaching 119,000 points for the first time in history. He viewed the positive business trend as a reflection of increasing confidence among traders and investors in the government’s policies.

The PM attributed the improvement in economic indicators and the overall business environment to the government’s economic policies over the past year. He further said that the government is prioritising providing a conducive environment for business and investment.

Meanwhile, Managing Director and CEO of Arif Habib Commodities Ahsan Mehanti said: "Stocks reached an all-time high, led by blue-chip scrips as investors weighed the IMF’s readiness to approve the government’s Rs1.5 trillion circular debt management plan."

“Government deliberations on the privatisation of SOEs and expectations of a cut in industrial power tariffs also played a catalyst role in the bullish close at PSX,” he added

Investor sentiment remained upbeat following reports that the IMF had approved Pakistan's request to borrow Rs1.25 trillion ($4.5 billion) from domestic banks to reduce circular debt without adding to the country's official public debt stock.

This development has strengthened market confidence and led to increased inflows from investors seeking to capitalise on expected economic improvements.

“The market made a new high, prompting technical players to initiate new long positions,” said Ahfaz Mustafa, CEO of Ismail Iqbal Securities. “This, combined with the IMF news and circular debt resolution discussions, is giving investors renewed confidence.”

The bullish trend was further supported by the government's Rs392 billion raised through the auction of market Treasury Bills on Wednesday. However, this fell short of the Rs800 billion target and was lower than the Rs513 billion maturity amount.

According to the State Bank of Pakistan (SBP), the cut-off yields on Treasury bills largely remained stable except for the 12-month paper, which saw a slight increase of 26 basis points (bps) to 11.8999%.

The yield on the one-month Treasury bill stood at 12.0498%, while the three-month paper remained unchanged at 11.8242%. The six-month T-bill closed steady at 11.6699%.

The stock market has now posted gains for five consecutive sessions, with the bullish rally led by energy and banking stocks.

-

Bitcoin crashes below $63K as regulatory pressure and market fears grow

-

Bitwise Crypto Industry innovators ETF: What investors should do in 2026?

-

Nintendo shares slide again as momentum fears grow

-

Gold, silver prices fallen sharply; What’s driving the drop?

-

Gold’s record climb: Experts question if its safety is ‘overstated’

-

Dubai unveils plans to construct street built with real gold

-

Netflix slams Paramount’s bid: 'Doesn't pass sniff test’ as Warner battle escalates

-

Ubisoft: Shares plunge amid restructuring plan and wave of games cancellations