£2.28M Tax Bombshell! Zara Tindall, Peter Phillips at risk

The sprawling 700-acre property, located in Gloucestershire, is valued at an estimated £6 million

Princess Anne's children, Zara Tindall and Peter Phillips, may face a significant financial challenge if they inherit their mother's Gatcombe Park estate.

The sprawling 700-acre property, located in Gloucestershire, is valued at an estimated £6 million and has been the Princess Royal’s cherished home since the late 1970s.

The estate also houses Zara, her husband Mike Tindall, and their three children, alongside Peter Phillips and his family, who live in separate accommodations on the grounds.

The estate was purchased by the late Queen Elizabeth in 1976 and has since been a cornerstone of Anne’s private life. Royal experts have long speculated that Zara and Peter would inherit Gatcombe Park, with Simon Vigar, royal correspondent for 5 News, calling it Anne’s “forever home.”

Ingrid Stewart, editor-in-chief of Majesty Magazine, added, "There’s no doubt that Zara and Peter will strive to keep Gatcombe going. Selling it would be the last thing they’d ever want to do."

However, inheriting the property could come with a staggering inheritance tax burden.

According to property expert Terry Fisher, the UK’s inheritance tax (IHT) rate is currently 40% for estates exceeding the £325,000 threshold. This could translate to a tax bill of approximately £2.28 million for Zara and Peter, unless they qualify for exemptions or reliefs.

Fisher explained, "Inheritance tax payments are typically due within six months of the inheritance, which could put additional financial pressure on heirs, especially if they don’t have access to liquid assets."

While the prospect of keeping Gatcombe Park within the family aligns with Anne’s legacy, navigating this financial hurdle will likely require careful planning to preserve the estate’s future.

-

Backstreet Boys voice desire to headline 2027's Super Bowl Halftime show

-

Allison Holker gets engaged to Adam Edmunds after two years of dating

-

Timothée Chalamet turns head on the 'show with good lighting'

-

Cardi B shares emotional message amid Stefon Diggs split rumors

-

Kate Hudson explains why acting isn't discussed at home

-

Why Kanye West feels 'weird' about Kim Kardashian dating pal Lewis Hamilton?

-

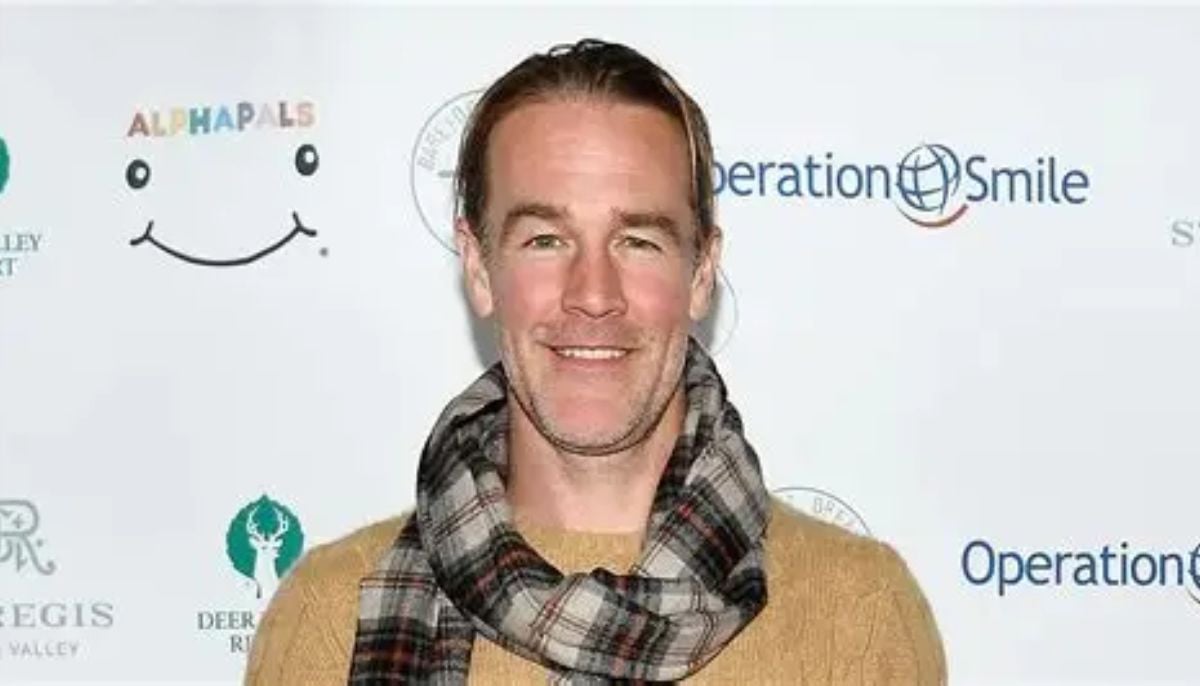

James Van Der Beek's quiet sacrifice before death comes to light

-

Margaret Qualley shares heartfelt confession about husband Jack Antonoff: 'My person'