Inflation creeps up to 7.2% in Oct as SBP gets ready for policy rate decision

Inflation figures beat market as well as government forecasts of around 6.8%, but remain in single-digits

Pakistan's annual inflation edged up to 7.2% in October 2024, registering an increase from 6.9% in September but marking a significant decrease from 26.8% in October 2023, data from the Pakistan Bureau of Statistics (PBS) showed on Friday, just days before the central bank’s meeting to decide the key policy rate.

The reading reinforced months of easing inflation — which hit a historic high of 38% last year and was at 26.8% in October 2023 — ahead of a meeting of the country's central bank next week to review the policy rate, which stands at 17.5%.

This increase in the Consumer Price Index (CPI) inflation beats the market as well as government forecasts of 6.8%, bringing the average inflation for the first four months of FY2025 to 8.7%, down from 28.5% in the same period of FY2024.

On a monthly basis, the CPI increased 1.2% in October, reversing from a 0.5% decline in September and up from a 1.0% increase in October 2023.

Core inflation, excluding food and energy, increased by 9.8% year-on-year in October, slightly lower than September’s 10.4% rise and well below the 21.8% recorded a year earlier.

Month-on-month, core CPI edged up 0.6% in October, compared to a 0.3% increase in September and a 1.1% rise in October 2023.

Ministry of Finance in its monthly economic outlook released on Wednesday projected the inflation to hover around 6-7% in October and was optimistic that it would fall as low as 5.5–6.5% in November 2024.

Economic recovery will take advantage of declining inflation and the continuation of fiscal consolidation in the coming months, the report added.

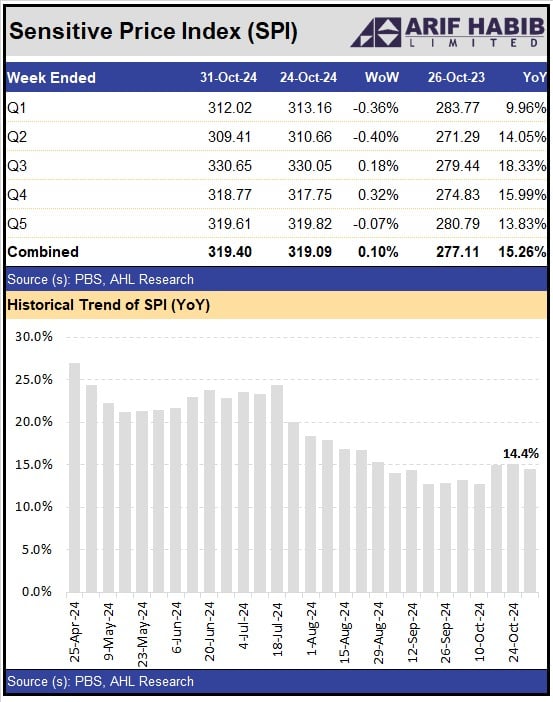

Meanwhile, the Sensitive Price Index (SPI) for the week ended October 31, 2024 recorded an increase of 15.26% year-on-year and increase of 0.10% week-on-week.

Anticipating a slight monthly increase, Topline Securities earlier this month forecast that the inflation would continue to lose steam into October.

The brokerage expected the CPI for October to rise between 6.5% and 7.0% year-on-year, with a marginal 0.9% increase month-on-month, which would bring the average inflation for the first four months of FY25 to 8.6%, down sharply from 28.5% in the same period last year.

Inflation poses significant challenges to the economy, peaking at a record 38% in May last year before gradually retreating.

The trend has continued with September’s CPI at 6.9% year-on-year, down from 9.6% in August, marking the lowest inflation rate since January 2021, according to Pakistan Bureau of Statistics (PBS) data.

Topline analysts also noted that with inflation in the range of 6.5-7.0% in October, Pakistan’s real rates are set to reach 1,050 to 1,100 basis points above inflation, a sizable increase compared to the historic average of 200-300 basis points, which could lead the central bank to tighten its monetary policy regime.

Meanwhile, Finance Minister Muhammad Aurangzeb in an interview with Reuters said, "The International Monetary Fund (IMF) has lowered its inflation forecast for Pakistan for the current year to 9.5%."

According to Aurangzeb, the IMF’s revised projection brings it closer to Pakistan’s own projections.

“The IMF also revised down its import projections for Pakistan in the current fiscal year to $57.2 billion,” the finance minister added.

-

Will Warner Bros finalize deal with Paramount or stays loyal with Netflix's offer?

-

$44 billion Bitcoin blunder: Bithumb exchange apologizes for accidental payout

-

Global memory chip crunch puts spotlight on Apple; Will iPhone become more pricey?

-

Bitcoin plummets toward $60,000 as investors dump risky bets

-

Bitcoin crashes below $63K as regulatory pressure and market fears grow

-

Bitwise Crypto Industry innovators ETF: What investors should do in 2026?

-

Nintendo shares slide again as momentum fears grow

-

Gold, silver prices fallen sharply; What’s driving the drop?