Pakistan requests $1bn in IMF climate cash, sees reserves rising

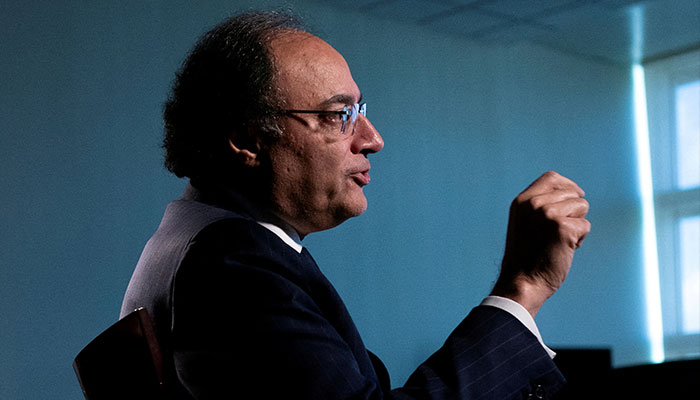

Islamabad also in talks with AII Bank for credit enhancement for planned Panda bond, says Aurangzeb

WASHINGTON: Finance Minister Muhammad Aurangzeb said that Pakistan has formally requested around $1 billion funding from the International Monetary Fund (IMF) facility that helps lows and middle income countries mitigate climate risk.

"We have formally requested to be considered for this facility," the finance minister said in an interview to Reuters on the sidelines of the IMF/World Bank autumn meetings in Washington.

The International Monetary Fund had already agreed a $7bn bailout for Pakistan, but has further funding available via its Resilience and Sustainability Trust (RST).

The RST, created in 2022, provides long-term concessional cash for climate-related spending, such as adaptation and transitioning to cleaner energy.

The South Asian nation is one of the most vulnerable countries to climate change according to the Global Climate Risk Index.

Floods in 2022, which scientists said was aggravated by global warming, affected at least 33mn people and killed more than 1,700.

The country's economic struggles and high debt burden impinged its ability to respond to the disaster.

Pakistan is also in talks with the Asian Infrastructure Investment Bank for a credit enhancement for a planned Panda bond, with an initial issue of $200-250mn, Aurangzeb said.

A Panda bond issuance would be Pakistan's first foray into China's capital markets. Aurangzeb said they were talking to "a few other institutions" in addition to the AIIB for a credit enhancement.

Credit enhancements provide some level of guarantee for bonds, which can boost their rating, attract more investors and thus cut the government's borrowing costs.

Issuing in the world's "second largest and the second deepest" capital market, Aurangzeb said, was the key aim, rather than a particular issuance size.

"From our perspective it is diversification of the funding base," Aurangzeb. "Even if the inaugural issue is not significant in size, for us it is important that we print that and of course then we can keep it on tap."

Aurangzeb said Pakistan has engaged with Middle Eastern banks regarding commercial loans, and one had submitted "a relatively significant proposal."

Pakistan's foreign exchange reserves should reach $13 billion by the end of March, Aurangzeb said, which would help with commercial lending, and potentially its credit rating.

The foreign exchange reserves reached $11.04 billion in the week ending Oct. 18, the central bank said.

Moody's upgraded Pakistan's ratings to 'Caa2' in August, citing improving macroeconomic conditions, and Fitch boosted its rating to CCC+ in July following the IMF staff level agreement. But both ratings are sub investment grade.

-

BTC price today: Bitcoin sinks below $65K on trade uncertainty

-

Tesla expands Cybertruck lineup with affordable model in US, slashes Cyberbeast price to boost demand

-

Uber enters seven new European markets in major food-delivery expansion

-

Will Warner Bros finalize deal with Paramount or stays loyal with Netflix's offer?

-

$44 billion Bitcoin blunder: Bithumb exchange apologizes for accidental payout

-

Global memory chip crunch puts spotlight on Apple; Will iPhone become more pricey?

-

Bitcoin plummets toward $60,000 as investors dump risky bets

-

Bitcoin crashes below $63K as regulatory pressure and market fears grow