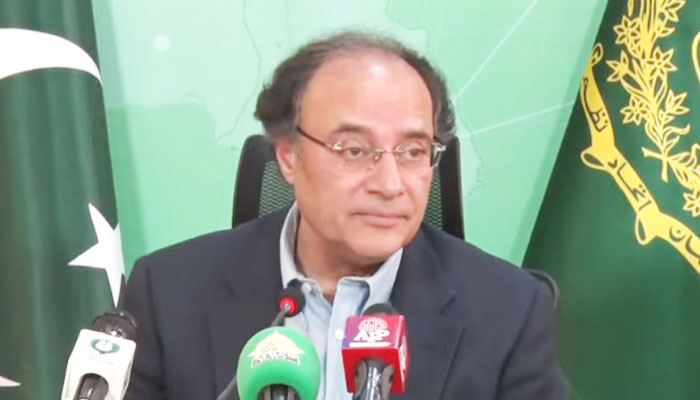

Govt has complete data of 4.9m non-filers: FinMin Aurangzeb

Finance minister says FBR's tax officers will not be able to send notices directly to non-filers

Finance Minister Muhammad Aurangzeb has said that reforms are being introduced to the Federal Board of Revenue (FBR) as part of the government's efforts to broaden the tax net by bringing 4.9 million non-filers into tax net, adding that Prime Minister Shehbaz Sharif is chairing weekly meetings in this regard.

The finance minister, while addressing a press conference in Islamabad on Sunday, said that the tax officers won't be able to issue notices directly to non-filers with a view to putting an end to their harassment.

Non-filers will be issued notices through a centralised mechanism, he added, field formations will be authorised to collect taxes accordingly.

He also stressed that there are 4.9 million non-filers, whose complete lifestyle data is available with the government.

The finance czar expressed gratitude to the chief ministers of all four provinces for supporting the government's tax reforms agenda, hoping that they will introduce tax legislation for inclusion of the agricultural sector in the taxation regime.

He said without including the untaxed and under-taxed community into the tax regime, the government cannot achieve the certainty and ease of collection that is vital for economic stability.

Regarding facilitation to the business community, Aurangzeb said that claims worth Rs68 billion have so far been refunded since July 1.

The finance minister also stressed the need for urgent structural reforms in the energy sector to address issues related to independent power producers (IPPs), inflated electricity bills, and other irregularities that burden the national exchequer and consumers.

"We need to move towards structural solutions. We have provided an immediate solution, but we must also follow through with structural reforms," the minister said during a press conference in Islamabad.

His comments come amid outcry over capacity payments being made to IPPs through consumers' monthly electricity bills, which are already burdened with taxes and the highest tariffs in the country’s history.

Political leaders, civil society, and the general public have criticised the government for increasing power rates and have called on authorities to revisit their agreements with IPPs.

The Jamaat-e-Islami (JI) has also taken to the streets, staging a sit-in in Rawalpindi against the payments being made to IPPs and the "inflated electricity bills."

Cash-strapped consumers are being forced to pay skyrocketing power bills at a time when the headline inflation rate has reached 12.6% (June 2024).

"We can make emotional decisions and react emotionally, but we also need to attract both local and foreign investment. We cannot completely disregard the integrity of our agreements with the IPPs," Aurangzeb said.

The finance minister emphasised that short-term and knee-jerk reactions will not lead to a comprehensive structural transformation of the country's various sectors of economy.

Despite the government taking steps such as introducing an industrial package, ending cross-subsidies, and providing subsidies for consumers using up to 200 units, more needs to be done.

He stated that the government was making every effort not to burden the low-income section of society and mentioned plans to include agriculture in the tax regime, with chief ministers of all provinces responsible for enacting agri-tax legislation.

-

Will Warner Bros finalize deal with Paramount or stays loyal with Netflix's offer?

-

$44 billion Bitcoin blunder: Bithumb exchange apologizes for accidental payout

-

Global memory chip crunch puts spotlight on Apple; Will iPhone become more pricey?

-

Bitcoin plummets toward $60,000 as investors dump risky bets

-

Bitcoin crashes below $63K as regulatory pressure and market fears grow

-

Bitwise Crypto Industry innovators ETF: What investors should do in 2026?

-

Nintendo shares slide again as momentum fears grow

-

Gold, silver prices fallen sharply; What’s driving the drop?