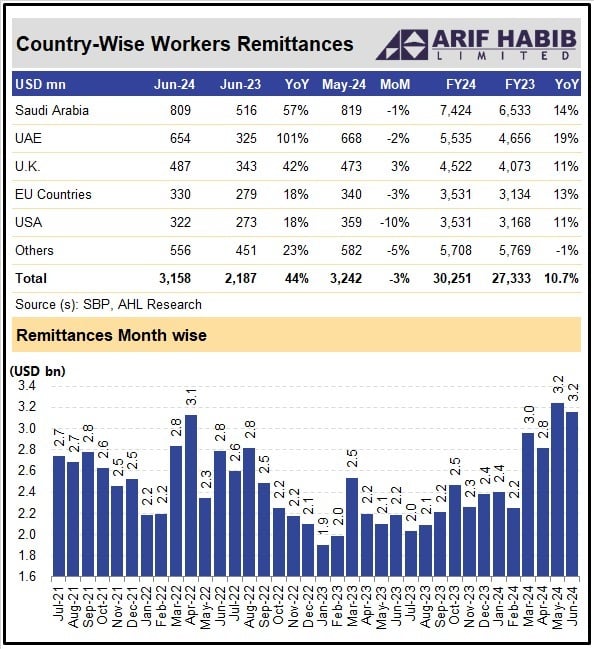

Overseas workers' remittances surge to $30.3bn in FY24; up 10.7%

On a month-on-month basis, inflows eased 3% to $3.16 billion in June 2024 from $3.24 billion in May 2024

Remittances sent home by overseas workers hit $30.3 billion in the fiscal year 2023-24 (FY24), up 10.7% year-on-year from $27.3 billion in the fiscal year 2022-23 (FY23), State Bank of Pakistan (SBP) data showed on Tuesday. This increase is attributed to a rise in fund transfers through official and legal channels.

However, on a month-on-month basis, inflows eased 3% to $3.16 billion in June 2024 from $3.24 billion in May 2024, but year-on-year swelled 44% compared to $2.2 billion registered in the same month a year ago.

This improvement can be attributed to the fact that more overseas Pakistanis sent funds home through official channels like regulated banks and foreign currency exchange companies due to a stable currency, analysts said.

This shift is mainly a result of a crackdown on illegal dollar activity, dollar speculators, and money changers.

They said that more use of regulated money transferring channels, a spike in Pakistani immigrants in other countries, and the nation's stable currency and economy were the main causes of the boost in remittances in the last fiscal year.

A World Bank report titled "Migration and Development Brief 40" published last month said that in terms of remittances received from overseas workers, Pakistan was among the top five recipients in 2023.

It says remittances flowing into Pakistan are forecast to recover and grow at about 7.0% to reach $28 billion in 2024 and increase at 4.0% to about $30 billion in 2025.

“The top five recipient countries for remittances in 2023 are India with an estimated inflow of $120 billion, followed by Mexico ($66 billion), China ($50 billion), the Philippines ($39 billion), and Pakistan ($27 billion),” according to the report.

Overseas Pakistanis in Saudi Arabia sent home the largest amount in June 2024, with $808.6 million sent during the month. This amount was 1% lower than the previous month but 57% higher than the $516.1 million sent in the same month last year.

Inflows from the United Arab Emirates (UAE) also dropped by 2% from $668.4 million in May to $654.3 million in June. However, compared to the same month last year, remittances increased by 101%, up from $324.8 million.

Remittances from the United Kingdom totaled $487.4 million in June, a 3% increase from $473 million in May 2024.

Meanwhile, remittances from the European Union fell nearly 3% month-on-month to $330 million in June 2024. Overseas Pakistanis in the US sent $322.1 million in June 2024, a 10% decrease from the previous month.

At a time when the world faces an extremely challenging outlook, remittances are a vital lifeline for households in developing countries, especially the poorest, according to a World Bank document.

Remittances are primarily money that migrants send home to support their family.

They alleviate poverty, improve nutritional outcomes, and are associated with increased birth weight and higher enrollment rates for children in disadvantaged households.

Studies show that remittances help recipient households build resilience, for example, through financing better housing and recovering from losses in the aftermath of disasters, as per a World Bank report.

-

Bitcoin plummets toward $60,000 as investors dump risky bets

-

Bitcoin crashes below $63K as regulatory pressure and market fears grow

-

Bitwise Crypto Industry innovators ETF: What investors should do in 2026?

-

Nintendo shares slide again as momentum fears grow

-

Gold, silver prices fallen sharply; What’s driving the drop?

-

Gold’s record climb: Experts question if its safety is ‘overstated’

-

Dubai unveils plans to construct street built with real gold

-

Netflix slams Paramount’s bid: 'Doesn't pass sniff test’ as Warner battle escalates