Elon Musk's xAI startup receives huge investment from Saudi Prince Alwaleed bin Talal

Prince Alwaleed's Kingdom Holding Company leads funding round for Elon Musk’s startup

Prince Alwaleed bin Talal, a well-known Saudi investor, has invested into billionaire Elon Musk's $24 billion startup called xAI.

The move shows Saudi Arabia's growing interest in artificial intelligence.

The Musk's startup xAI focuses on developing advanced AI systems, including Grok, which is AI chatbot for his social media site X.

Recently, xAI announced that it secured $6 billion in Series B funding, with Prince Alwaleed and other firms like Andreessen Horowitz, Sequoia Capital, Fidelity Management & Research Company, Valor Equity Partners, and Vy Capital participating.

The company's website reported that Prince Alwaleed's Kingdom Holding and its chairman as key investors.

Kingdom Holding Company's (KHC) 5% is listed on the Saudi stock exchange and remaining 95% is owned by Prince Alwaleed.

Elon Musk's startup also enjoys the backing by Saudi Arabia's sovereign wealth fund, which acquired a $1.05 billion stake in xAI in 2022. The fund has approximately $900 billion in assets.

Elon Musk intends to use the newly raised funds to launch xAI's initial products, enhance infrastructure, and accelerate research and development for future technologies.

The startup will start releasing exciting updates and product announcements in the coming months.

The Kingdom Holding also has a stake in Musk's social media platform X (formerly Twitter).

It should be mentioned that Prince Alwaleed's investment portfolio covers US bank Citigroup, ride-hailing service Lyft, and luxury hotel chains like Four Seasons Hotels & Resorts, Hotel George V in Paris, and the Savoy Hotel in London.

Additionally, he owns a significant share of Arabic-language media firm Rotana.

-

Scientists reveal how sleeping can unlock your creative potential

-

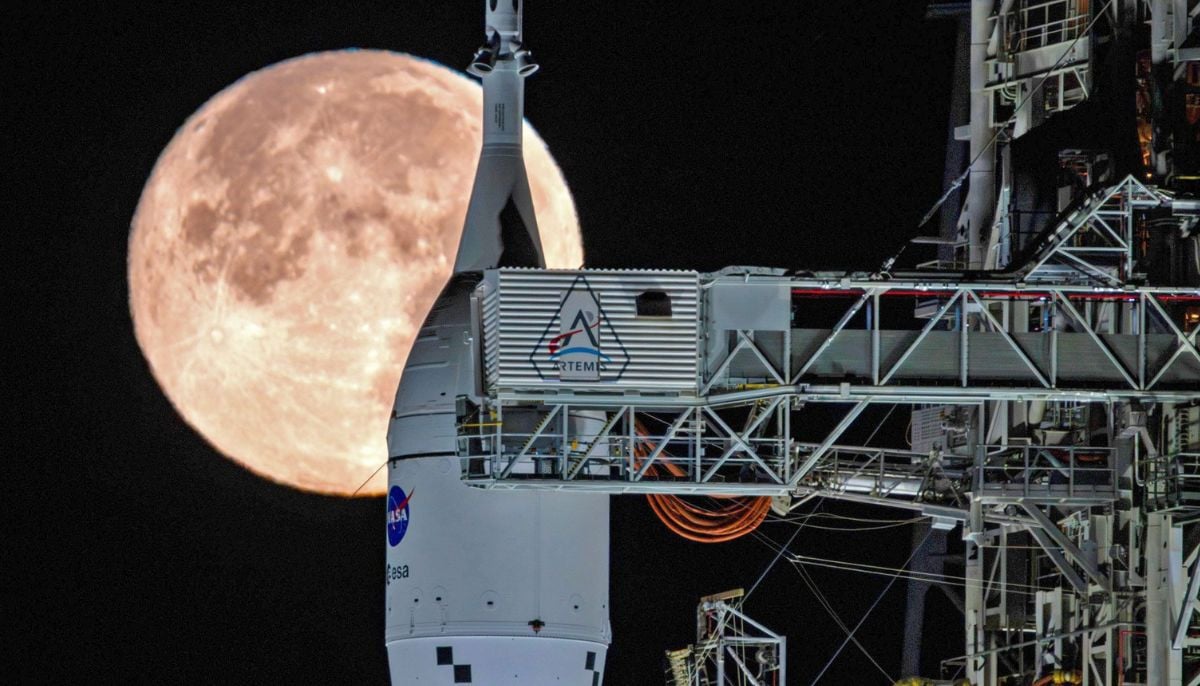

NASA Artemis 2 moon mission faces unexpected delay ahead of March launch

-

Total Lunar eclipse: What you need to know and where to watch

-

Sun appears spotless for first time in four years, scientists report

-

SpaceX launches another batch of satellites from Cape Canaveral during late-night mission on Saturday

-

NASA targets March 6 for launch of crewed mission around moon following successful rocket fueling test

-

Greenland ice sheet acts like ‘churning molten rock,’ scientists find

-

Space-based solar power could push the world beyond net zero: Here’s how