KP govt announces budget FY25 with total outlay of Rs1,754bn

KP eyes Rs93.5 billion revenue for FY 2024-25; proposes 10% hike in salaries and pensions

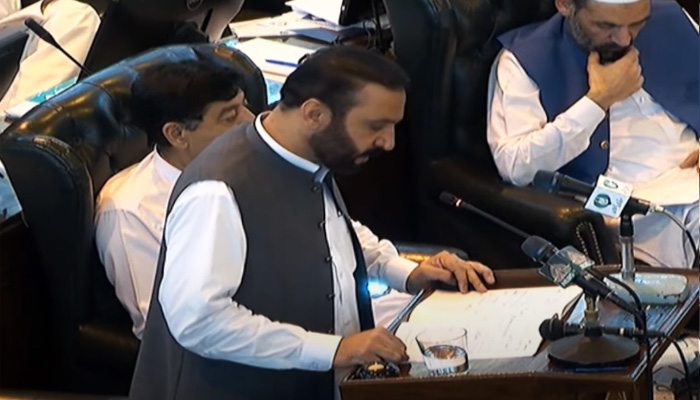

The Khyber Pakhtunkhwa (KP) government on Friday unveiled its annual budget for the fiscal year 2024-25 with a total outlay of Rs1,754 billion, with a surplus of Rs100 billion.

The government has projected Rs 1,654 billion in expenses, said the minister during a budget speech in the assembly, adding that as per the instructions of Chief Minister Ali Amin Gandapur, the budget 2024-25 mainly focused on social protection, peace, employment opportunities, and economic development.

The government has proposed a 10% increase in both salaries and pensions of the government employees besides raising the minimum wage from Rs3,2000 to 36,000.

He detailed that the KP government anticipates receiving a total of Rs1,754 billion under different heads during the fiscal year 2024-25, including Rs1212.036 billion from the federal government under Federal Tax Assignment, 1% of the divisible pool on war on terror, straight transfer under the head of royalties and surcharge on oil and gas, windfall levy and net hydel profit.

He said that the province considerably improved its income during the last few years and had chalked out a mobilisation plan and fixed a target of achieving Rs93.5 billion revenue for the fiscal year 2024-25.

Similarly, Rs31.55 billion would be received from other receipts, Rs259.92 billion from merged districts, Rs130.59 billion from foreign projects assistance and Rs26.41 billion from development and non-development grants under the Public Sector Development Programme (PSDP).

The KP government has decided to improve the tax net instead of increasing the taxes and for this purpose, several steps have been taken including reforms in sales tax, property tax, tobacco tax, cess and other taxes, the minister added.

The government has decreased the sales tax ratio on different online services in the budget, adding that the tax has been reduced on hotels from 8% to 6% and bound the hotels to use the “Restaurant Invoice Management System”.

Similarly, a fixed sales tax rate has been proposed for wedding halls.

Aftab said the government has also given relief in property tax and reduced the tax amount per kanal for factories from Rs13,600 to Rs10,000.

The tax on commercial property which was 16% of the monthly rent previously has been reduced to 10% and 5% for private hospitals, medical stores and other businesses related to the health sector.

Additionally, the government proposed to increase the tobacco development cess to increase income on the production of tobacco, he said and informed the house that the government has reduced provincial tax from 6.5% to 3.5% on the transfer of properties.

The government has earmarked Rs362.7 billion for the education sector, including Rs35.8 billion for higher education and Rs326.9 billion for elementary and secondary education.

As per the instructions of the chief minister, the government has allocated Rs12 billion for Ehsaas Naujawan, Ehsas Rozgar and Ehsas Hunar programmes to provide opportunities to 100,000 youth.

The government has earmarked Rs10 billion for the Chashma Right Bank Canal (Lift-Cum-Gravity) project to bring 300,000 acres of barren land under cultivation to overcome food security issues.

Similarly, an amount of Rs228.8 billion has been allocated for the health sector. Rs140.6 billion has been allocated for law and order in the province.

Other allocations include Rs60.5 billion for roads and infrastructure, Rs8.1 billion for social welfare, Rs2 billion for mineral, Rs7.5 billion for industry and commerce, Rs9.6 billion for tourism, Rs28.6 billion for agriculture, and Rs30.8 billion for energy sector.

The current expenditure for the settled districts for the fiscal year 2024-25 was estimated at Rs1093.087 billion including provincial salaries, Health MTIs’ salary budget, Tehsil Salary, pension and non-salary expenditures of health MTIs, Tehsil, capital expenditure and ways and means.

Similarly, the current expenditure for the merged districts was estimated at Rs144.62 billion, including provincial salary, tehsil salary, pension, non-salary, temporarily displaced persons and non-salary expenditure of tehsils.

The province has allocated Rs416.30 billion for development expenditures for settled and merged districts, including Rs120 billion for the Provincial Annual Development Program, Rs24 billion for the district annual development program, Rs36 billion for the merged districts' annual development program, Rs79.29 billion for Accelerated Implementation program (AIP), Rs130.59 billion for foreign project assistance and Rs26.41 billion for federal PSDP.

Presenting budget 2024-25 on the floor of the house, the finance minister said that 5,000 new houses would be constructed under Ehsas Own House Program for which Rs3 billion was allocated.

Likewise, Rs10 billion was earmarked for CRBC Lift Canal to irrigate three lakh acres lands, launching of Tank, Chodran and Daraban dams, allocation of Rs26.90 billion for wheat procurement, Rs6.50 billion for construction of roads, Rs2.50 billion for emergency works, construction of Dir and DI Khan Motorway under public-private partnership mode, construction of a road to link DI Khan with Hakla Motorway and 470 megawatt Lower Spat Gah project.

For law and order, the KP government announced Rs140.62bn for the improvement of law and order which is 12% more compared to last fiscal year while the PEHL 911 project was being launched in the home department.

The budget of the social welfare department increased to Rs8.11 billion which is 6% more, whereas, the shelter homes’ programme budget jacked up to Rs600 million against Rs300 million in the last fiscal year in merged tribal districts.

Similarly, Rs7.53 billion for industries, Rs9.66 billion for tourism with a project of field heritage school and tourism helpline 1422, Rs28.93 billion for agriculture with olives project, Rs31.54 billion for energy sector with the establishment of KP distribution company and launching of Batakundi-Naran hydro project to produce 235 MW announced in budget 2024-25.

Besides the allocation of Rs14.69 billion for livestock and Rs14.05 billion for forestry with the launching of the Billion Trees Plus Project, the KP government also announced a 10% each increase in basic pay of its employees and pensioners besides increased minimum wages to Rs36,000 from existing Rs32,000.

The minister said that the budget 2024-25 was not just a budget document rather it was also a roadmap for the development and prosperity of the province and a reflection of the government’s strong resolve to uphold social justice and gender equality.

Concluding his budgetary speech, he thanked the finance department, planning and development for drafting the budget document within a short span of time.

-

Uber enters seven new European markets in major food-delivery expansion

-

Will Warner Bros finalize deal with Paramount or stays loyal with Netflix's offer?

-

$44 billion Bitcoin blunder: Bithumb exchange apologizes for accidental payout

-

Global memory chip crunch puts spotlight on Apple; Will iPhone become more pricey?

-

Bitcoin plummets toward $60,000 as investors dump risky bets

-

Bitcoin crashes below $63K as regulatory pressure and market fears grow

-

Bitwise Crypto Industry innovators ETF: What investors should do in 2026?

-

Nintendo shares slide again as momentum fears grow