Nepra jacks up electricity tariff by Rs2.83 per unit for May bills

Electricity prices jacked up on account of fuel charges adjustment for month of March

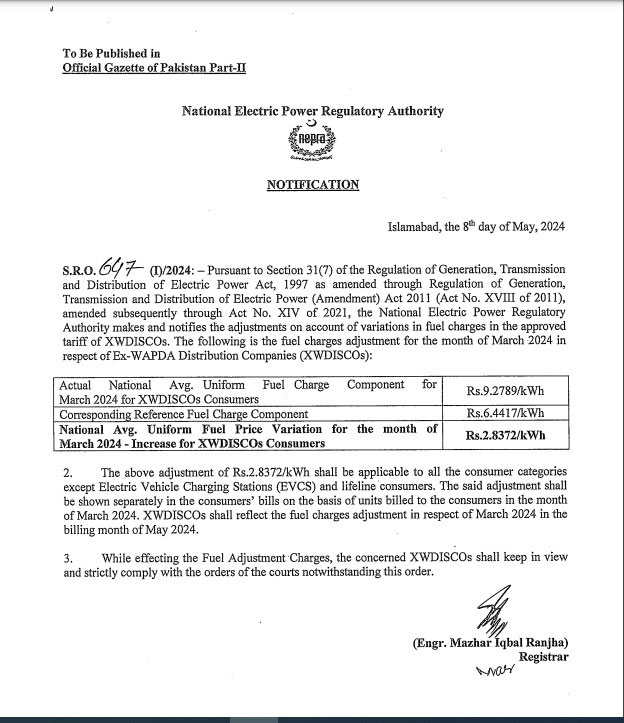

Putting an additional burden on the inflation-hit masses, the National Electric Power Regulatory Authority (Nepra) on Wednesday notified a Rs2.83 per unit hike in electricity tariff for the month of March 2024.

An official notification for the price hike stated that the tariff has been jacked up on account of fuel charges adjustment, which will be reflected in the bills issued in May.

It stated that the said adjustment of Rs2.8372.kWh will be applicable to all the consumer categories except the Electric Vehicle Charging Stations (EVCS) and lifeline consumers.

“The adjustment will be shown separately in the conumers’ bills on the basis of unites billed to the consumers in the month of March 2024,” it added.

Moreover, the said price hike will also not be applicable to K-Electric consumers.

Nepra directed all the Distribution Companies (Discos) concerned to strictly comply with the orders of the courts notwithstanding this order.

Last month, the Ministry of Power Division announced that the power consumers were likely to get another relief of Rs4.12 per unit in the electricity bills in the month of May as a petition seeking price cut from Rs2.94 to Rs4.92 per unit in terms of fuel cost adjustment had been submitted to Nepra.

Earlier in March, Nepra okayed a hike of Rs2.75 per unit in power tariff for the current quarter of the fiscal year 2023-24, putting an additional burden in exorbitant electricity bills for consumers.

This was approved in terms of quarterly adjustment for the second quarter of FY2023-24, having a uniform impact Rs2.75 per unit on each consumer.

-

Will Warner Bros finalize deal with Paramount or stays loyal with Netflix's offer?

-

$44 billion Bitcoin blunder: Bithumb exchange apologizes for accidental payout

-

Global memory chip crunch puts spotlight on Apple; Will iPhone become more pricey?

-

Bitcoin plummets toward $60,000 as investors dump risky bets

-

Bitcoin crashes below $63K as regulatory pressure and market fears grow

-

Bitwise Crypto Industry innovators ETF: What investors should do in 2026?

-

Nintendo shares slide again as momentum fears grow

-

Gold, silver prices fallen sharply; What’s driving the drop?