PSX soars to all-time high as it crosses 69,000 mark

KSE-100 index gains over 1,200 points to close at 69,619.98

KARACHI: Bulls gripped the Pakistan Stock Exchange (PSX) on Monday as the benchmark index achieved a new milestone by crossing the 69,000 mark.

The KSE-100 index gained 1,203.20 points or 1.76% to close at 69,619.98 points, up from the previous close of 68,416.78 points at the close of the day's trading.

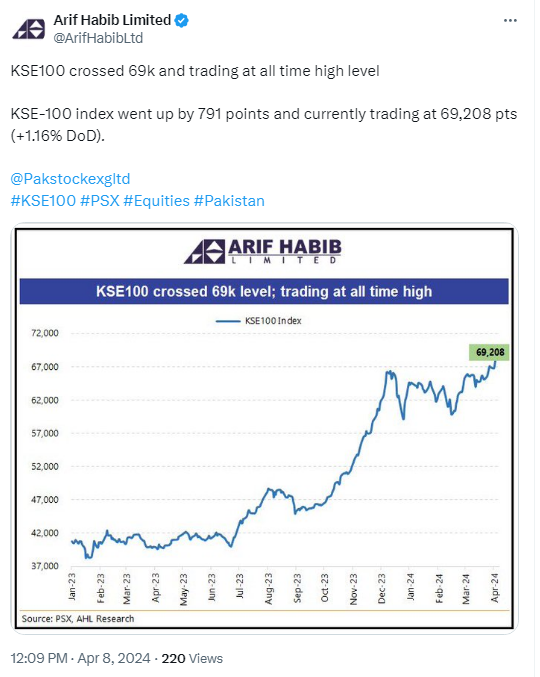

Arif Habib Limited, a brokerage house, noted in a post on X that the KSE-100 index crossed 69,000 and is trading at an all-time high.

Samiullah Tariq, the head of research at Pak-Kuwait Investment Company, attributed the gain to the stability on the economic front, hopes of a new International Monetary Fund (IMF) deal, the privatisation of the Pakistan International Airlines (PIA).

Khurram Schehzad, CEO of the Alpha Beta Core financial advisory firm, said that investors gained confidence due to "resuming the privatisation process with those making losses as a priority so the government fiscals can get better".

"[This is] followed by IMF's last tranche to be received in the coming week to support externals."

Stocks concluded the outgoing week on a high note, with expectations set for a positive performance in the upcoming short trading week, which will span only two days before the extended Eid holidays, traders told The News.

“In the upcoming week, we expect the market to remain positive,” said brokerage Arif Habib Ltd. “Developments related to SOEs (state-owned enterprises) privatisation or EFF (Extended Fund Facility) program with IMF will further improve market sentiment.”

The market closed at 68,417 points, increasing by 1,412 points or 2.11% week-on-week.

-

Bitcoin crashes below $63K as regulatory pressure and market fears grow

-

Bitwise Crypto Industry innovators ETF: What investors should do in 2026?

-

Nintendo shares slide again as momentum fears grow

-

Gold, silver prices fallen sharply; What’s driving the drop?

-

Gold’s record climb: Experts question if its safety is ‘overstated’

-

Dubai unveils plans to construct street built with real gold

-

Netflix slams Paramount’s bid: 'Doesn't pass sniff test’ as Warner battle escalates

-

Ubisoft: Shares plunge amid restructuring plan and wave of games cancellations