Mick Jagger and Keith Richards' company generates £140m with minimal tax

Mick Jagger and Keith Richards pay only 1% tax, according to reports

Mick Jagger and Keith Richards holding company Promogroup BV, has amassed a substantial income of at least $180 million (£142 million) over the span of nine years.

The tax paid by the company amounts to less than 1 percent of this total revenue.

Since 2013, The Rolling Stone's company has quietly accumulated millions in earnings, according to the records.

In the most recent filing, submitted in March of this year, the company's directors disclosed that their 'receivables' for the period spanning January to December 2021 reached $25 million.

However, the tax paid during this time period amounted to a mere $213,000.

According to calculations spanning back to 2013, Promogroup has accumulated receivables totaling $180.9 million while the tax paid amounts to a mere $1.53m, equivalent to a tax rate of approximately 0.84 percent.

There is no indication that their company is acting unlawfully in its tax payments, and the individual tax liabilities of Mick Jagger and Keith Richards are not disclosed.

BV manages the financial affairs of Mick and Keith, and the estate of the late drummer Charlie Watts, while guitarist Ronnie Wood handles his own tax matters.

The band has a history of seeking legal avenues to minimize their tax obligations, dating back to 1971 when they entered tax exile after discovering a significant tax debt to HM Revenue and Customs.

-

Naomi Watt recalls daughter Kai slamming Met Gala dress in front of famed designer himself

-

Jasmin Lawrence, Eric Murphy excite fans by revealing baby's name post pregnancy announcement

-

Laura Ann Tull: Eric Dane's exit from 'Grey's Anatomy' contradicts accuser's claims

-

Druski steps in 'The Voice' for 'Battle of Champions' making history

-

Megan Thee Stallion ready for next step in love?

-

'Sentimental Value' star Renate Reinsve recalls sister's Leonardo DiCaorio mishap she prevented

-

Katy Perry's ex-husband, Russell Brand, pleads not guilty to further rape, sex assault charges

-

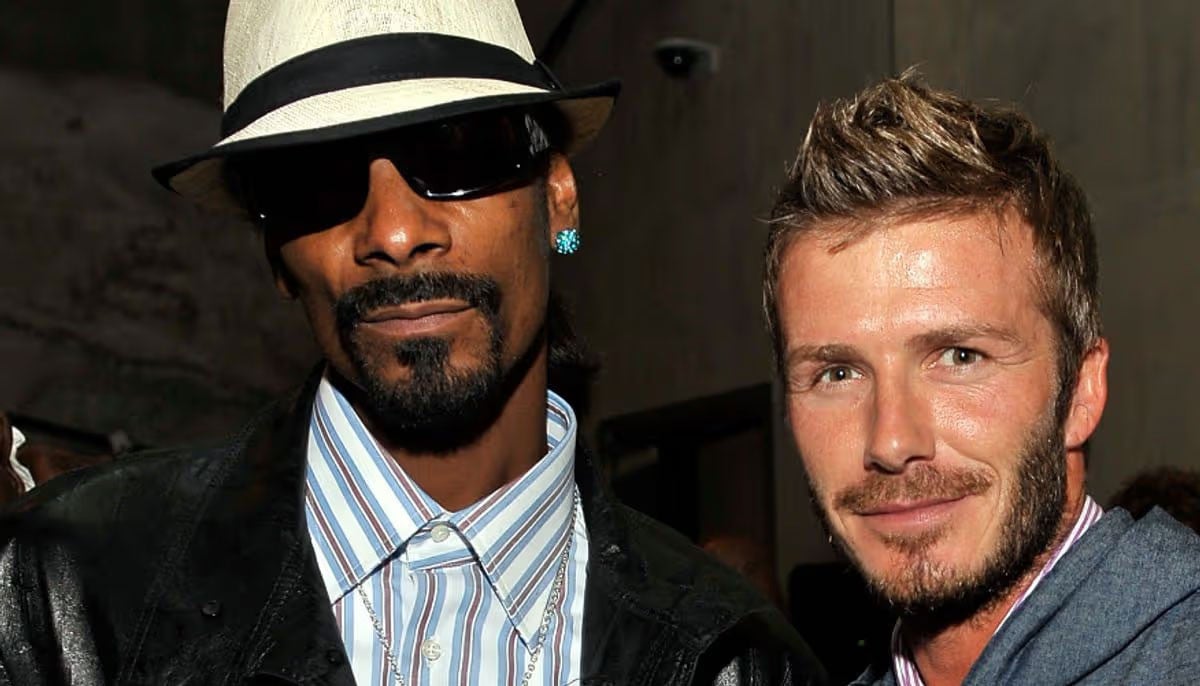

Snoop Dogg jumps into David Beckham, Brooklyn family feud with strong message: ‘No father is perfect’

_updates.jpg)