Pakistan gets first tranche of $1.2bn from IMF: Ishaq Dar

Finance minister says Pakistan would receive balance amount after two more reviews

The International Monetary Fund (IMF) has deposited $1.2 billion into the account of the State Bank of Pakistan (SBP), allowing breathing space to the cash-strapped economy, which has been dealing with the risk of default for almost a year.

The Fund's executive board late last night approved a $3 billion Stand-By Agreement (SBA) under a nine-month programme, after almost eight months of tough negotiations over fiscal discipline.

A staff-level agreement was made with the lender last month, which under a short-term pact got more than expected funding for the country as it underwent severe liquidity crunch, with the central bank reserves enough to provide for barely a month of controlled imports

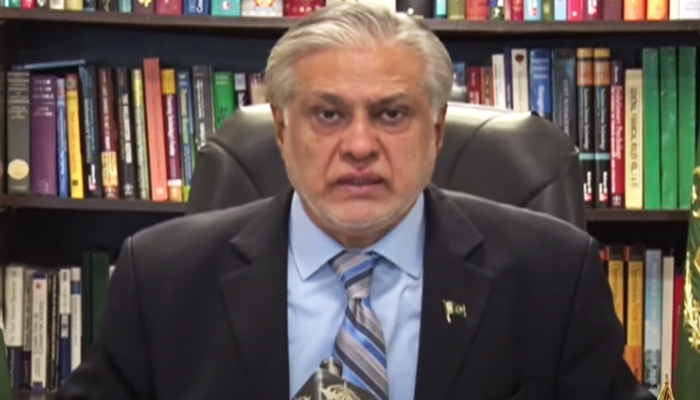

In a televised address from Islamabad, Finance Minister Ishaq Dar Thursday said Pakistan would receive the balance amount after two reviews — the second in November and the third in February.

This inflow will increase Pakistan's foreign exchange reserves, he said, noting that during the ongoing week, the central bank's reserves have moved up by around $4.2 billion.

"Our foreign exchange reserves will close at around $13-$14 billion on July 14 [...] and the SBP will release the exact numbers later on," the finance minister said, as he thanked Prime Minister Shehbaz Sharif for his efforts in securing the programme.

"Pakistan is on the road to development [...] we must all make efforts to make gains through this," Dar added.

"Our foreign exchange reserves will close at around $13-$14 billion on July 14 [...] and the SBP will release the exact numbers later on," the finance minister said, as he thanked Prime Minister Shehbaz Sharif for his efforts in securing the programme.

The prime minister played a key role in convincing the IMF to agree to the new programme as he repeatedly interacted with the lender's chief in Paris and on phone calls.

In a statement, the IMF said its executive board gave the green light to the nine-month standby arrangement in order "to support the authorities' economic stabilization program."

"Pakistan is on the road to development [...] we must all make efforts to make gains through this," Dar added.

Pakistan has suffered from a balance-of-payments crisis as it attempts to service crippling external debt amid a fraught political environment -- following the removal of the country's former prime minister Imran Khan.

Inflation has rocketed, the rupee has reached a record low against the dollar, and the country is struggling to afford imports, causing a severe decline in industrial output.

Pakistan has brokered close to two dozen arrangements with the IMF, most of which have gone uncompleted.

In the days before the decision was approved, Pakistan received $3 billion in deposits from Saudi Arabia and the United Arab Emirates.

The money from the two Gulf countries boosted Pakistan's foreign reserves to $7.5 billion — more than double last week's account balance.

-

Security forces gun down 30 terrorists in multiple IBOs in KP: ISPR

-

MQM-P calls for new province in Sindh

-

US report validates Pakistan military edge over India: PM

-

Banned TTP poses serious threat to Pakistan security: UNSC panel

-

CM Afridi clarifies remarks on by-poll after ECP requests army deployment

-

Dubai sees 3.2m Pakistani passengers in 2025 as airport sets new milestone

-

Security forces kill 23 Indian proxy terrorists in KP's Kurram

-

Pakistan to construct island to boost oil exploration: report