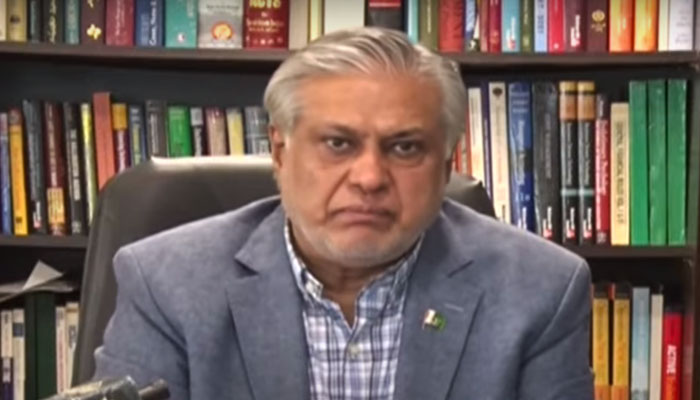

Ishaq Dar says Shell not closing business in Pakistan

"Shell company is not taking money abroad by selling its shares. The speculations are baseless," says Ishaq Dar

Finance Minister Ishaq Dar on Saturday rubbished speculations surrounding Shell's intent to exit Pakistan, saying that the global energy giant was neither closing its business in the country nor leaving anyone unemployed.

His comments came after Shell Pakistan Limited (SPL) announced on June 14 that its parent company, Shell Petroleum Company Limited, has notified its intent to sell its shareholding in the Pakistan unit.

"Shell is not closing its business in Pakistan. Any decision that the company takes, it is bound to implement the government's decisions," said the finance minister while speaking during a press conference.

Dar said that Shell wanted to sell its shares to a global investor, however, the employees will continue to work.

"Shell company is not taking money abroad by selling its shares. The speculations are baseless," said Dar, adding that this will "not impact the country."

The finance czar also said that the shares of Shell will be in Pakistan and will be transferred to someone else's name. He added that the Government of Pakistan knew about this decision a few months ago.

"The company is selling its shares to many countries including Germany and England. However, the business is not closing neither anyone is being unemployed," he clarified.

Speaking about the financing by the Chinese banks, Dar said that this has been Pakistan's arrangement that it pays the money back. He said that this process usually takes some weeks, however, the last payment took months.

"Keeping that in view as this fiscal year is ending on June 30, we contacted both Chinese banks and offered them that we will pay them before rather than paying in the last week," said the finance minister.

"If the payment is made before the date then the banks charge as per the standard practice. We also made an agreement with the banks that we will not pay any charges," he added.

Dar said that the external payments are being ensured, adding that Pakistan paid China on Monday. "We have made payments of $300 billion which will be rolled over in three to four days," he added.

-

Bitcoin plummets toward $60,000 as investors dump risky bets

-

Bitcoin crashes below $63K as regulatory pressure and market fears grow

-

Bitwise Crypto Industry innovators ETF: What investors should do in 2026?

-

Nintendo shares slide again as momentum fears grow

-

Gold, silver prices fallen sharply; What’s driving the drop?

-

Gold’s record climb: Experts question if its safety is ‘overstated’

-

Dubai unveils plans to construct street built with real gold

-

Netflix slams Paramount’s bid: 'Doesn't pass sniff test’ as Warner battle escalates