SBP-held forex reserves rise to $4.3bn after a meagre increase

Net forex reserves held by commercial banks stand at $5,527.7 million, $1,208.6 billion more than SBP

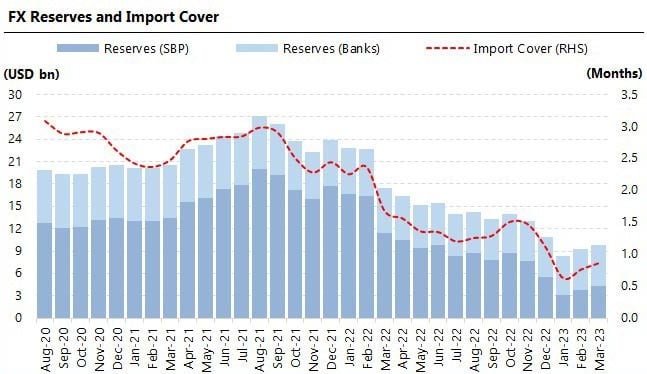

The State Bank of Pakistan (SBP)-held foreign exchange reserves maintained their uptrend for the second consecutive session, managing to stay above the $4 billion mark.

The reserves slightly rose above $18 million, however, the amount is still barely enough to cover one month of imports.

The central bank, in its weekly bulletin, said that its foreign exchange reserves have increased by $18 million to $4,319.1 million as of the week ended March 10, which will provide an import cover of around a month.

The net forex reserves held by commercial banks stand at $5,527.7 million, $1,208.6 billion more than the SBP, bringing the total liquid foreign reserves of the country to $9,846.8 million, the statement mentioned.

The central bank did not mention any specific reason behind an increase in SBP-held reserves.

Pakistan faces the renewed risk of recession amid a deepening political and economic crisis and a delay in the revival of the International Monetary Fund’s (IMF) bailout programme.

Bloomberg survey showed that the probability of the economy slipping into recession stands at 70%, according to the median forecast of 27 economists.

In the last few months, the cash-strapped nation has failed to meet several deadlines to secure funds to stave off a default, which has raised concerns that Pakistan might have to pause debt repayments.

In order to woo the IMF, Prime Minister Shehbaz Sharif-led government have raised taxes, cut energy subsidies, and hiked interest rates to a 25-year high to tamp down prices, but some issues are yet to be resolved.

Pakistan needs funds to revive its $350 billion economy, ease widespread shortages and rebuild its foreign currency reserves. The nation’s dollar stockpile has fallen to less than a month’s worth of imports, restricting its ability to fund overseas purchases, stranding thousands of containers of supplies at ports, forcing plant shutdowns and putting tens of thousands of jobs at risk.

-

Will Warner Bros finalize deal with Paramount or stays loyal with Netflix's offer?

-

$44 billion Bitcoin blunder: Bithumb exchange apologizes for accidental payout

-

Global memory chip crunch puts spotlight on Apple; Will iPhone become more pricey?

-

Bitcoin plummets toward $60,000 as investors dump risky bets

-

Bitcoin crashes below $63K as regulatory pressure and market fears grow

-

Bitwise Crypto Industry innovators ETF: What investors should do in 2026?

-

Nintendo shares slide again as momentum fears grow

-

Gold, silver prices fallen sharply; What’s driving the drop?