China banking tycoon Bao Fan 'cooperating with investigation'

Statement comes almost two weeks after Bao Fan's disappearance sparked fears of renewed crackdown on nation's financial services industry

BEIJING: Chinese billionaire Bao Fan is "cooperating in an investigation" by authorities, his company said, almost two weeks after his disappearance sparked fears of a renewed crackdown on the nation's financial services industry.

The China Renaissance chairman rose to fame as a key player in the emergence of some of the country's biggest tech giants, supervising blockbuster IPOs and the landmark 2015 merger between ride-hailing giant Didi and its top competitor at the time, Kuaidi Dache.

His Hong Kong-listed firm said in a filing dated Sunday that it was now "aware that Mr Bao is currently cooperating in an investigation being carried out by certain authorities" in mainland China.

"The Company will duly cooperate and assist with any lawful request from the relevant PRC authorities, if and when made," it added, referring to the country by its official name, the People's Republic of China.

The firm did not provide details about the nature of the investigation, and told AFP on Monday it had no additional comment.

Shares in the company slumped as much as 50 percent at one point following the February 16 announcement that he was missing, before clawing back to sit at around 30 percent down.

While yet to recover from that drop, the firm was up 2.1 percent in afternoon trading on Monday.

Chinese authorities have not given any details on Bao's detention or the reasons for the investigation.

According to financial news outlet Caixin, China Renaissance president Cong Lin was taken into custody last September as authorities launched a probe into his work at the financial leasing unit of state-owned bank ICBC. No further details have been shared about his case.

Powerhouse

China Renaissance has become a global financial institution since its founding in 2005, with more than 700 employees and offices in Beijing, Shanghai, Hong Kong, Singapore and New York.

The group has supervised the IPOs of several domestic tech giants, including leading e-commerce firm JD.com.

In 2015, Bao appeared on the Bloomberg Markets 50 Most Influential list, described as a "fast-talking" banker who had the ability to "arrange practically anything in China's vibrant tech scene".

The Shanghai-born son of government workers, Bao, 52, has enjoyed a globetrotting career that has seen him work for financial giants such as Morgan Stanley and Credit Suisse, including stints in the United States and Britain.

A 2014 profile in The New York Times described him as a congenial man with a penchant for open-necked shirts and an interest in mixed martial arts.

Bao is not the first high-profile Chinese financier to fall foul of the authorities in recent years, with President Xi Jinping leading an aggressive crackdown on alleged corruption.

In 2017, Chinese-Canadian businessman Xiao Jianhua was arrested by mainland authorities, receiving a 13-year jail sentence for corruption last August.

Known to have close ties to top Chinese Communist Party leaders, the billionaire was reportedly abducted from his Hong Kong hotel room by plainclothes police officers from Beijing.

Alibaba founder Jack Ma has also seen his fortune fall by around half to an estimated $25 billion after regulators pulled the plug on what would have been the world's biggest-ever IPO — that of fintech giant Ant Group.

A reshuffle of Ant's shareholding structure announced in January saw Ma, who has since receded from public view, cede control of the megafirm he founded in 2014.

-

Trump revokes legal basis for US climate regulation, curb vehicle emission standards

-

DOJ blocks Trump administration from cutting $600M in public health funds

-

Scientists find strange solar system that breaks planet formation rules

-

Woman calls press ‘vultures’ outside Nancy Guthrie’s home after tense standoff

-

Casey Wasserman to remain LA Olympics chair despite Ghislaine Maxwell ties

-

Gigi Hadid feels 'humiliated' after Zayn Malik's 'pathetic' comment: Source

-

Ontario tuition freeze ends, allowing colleges and universities to raise fees

-

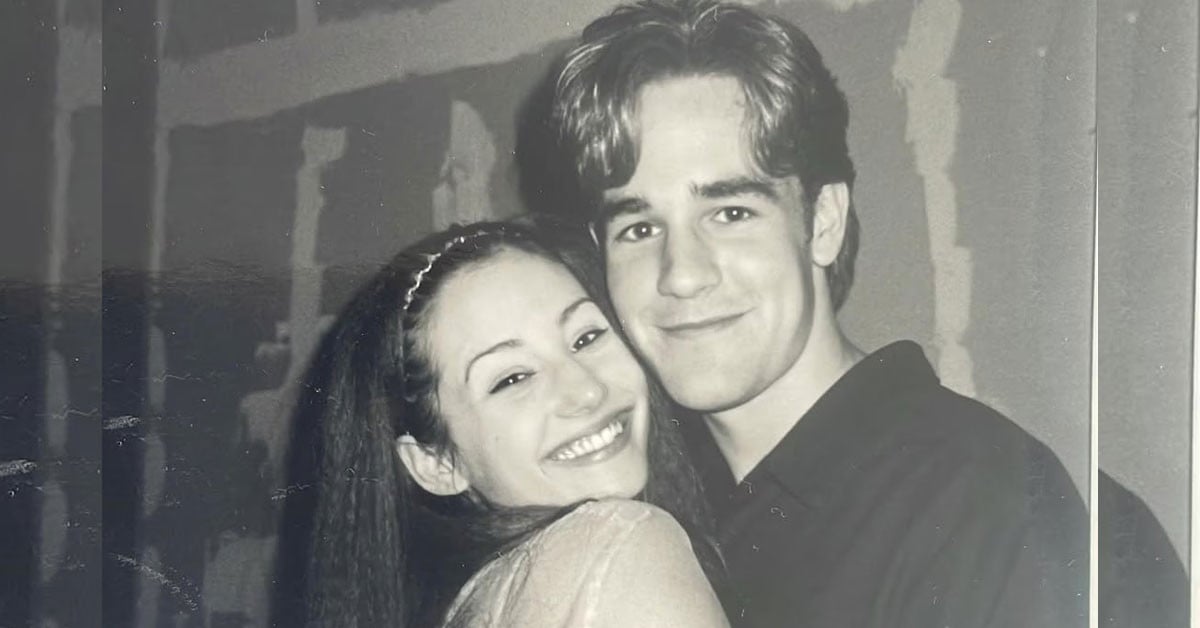

James Van Der Beek’s 'heartbroken' ex wife breaks silence of his death