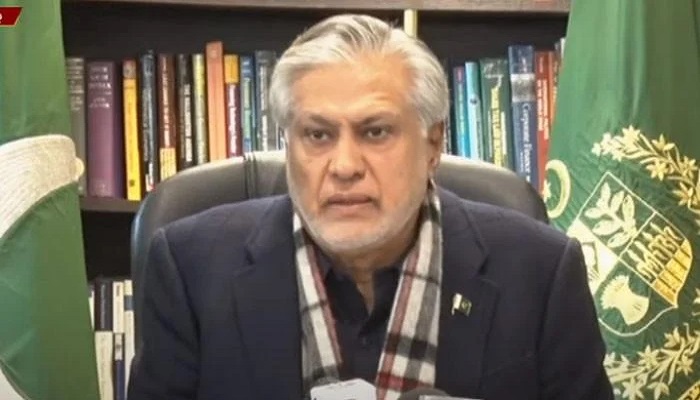

Rs170 billion in taxes will have to be imposed: Ishaq Dar

Virtual talks between IMF, Pakistan on Monday; finance czar Ishaq Dar confirms draft MEFP received from global lender

Under the deal with the International Monetary Fund (IMF), new taxes worth Rs170 billion will have to be imposed, for which a mini-budget will have to be introduced, Finance Minister Ishaq Dar announced Friday.

Dar was addressing a press conference after an IMF mission left Pakistan without signing a staff-level agreement, which the country was relying on to revive its failing economy.

The finance czar's address came shortly after the IMF issued a brief statement on its talks with Pakistan, which said that virtual talks would continue to finalise the implementation of key priorities.

Despite a failure in securing a deal with the IMF, the finance minister claimed the parleys with the global lender ended "positively".

He confirmed that the government had received the draft of the Memorandum of Economic and Financial Policies (MEFP) from the global lender which relates to the completion of the ninth review of a $7 billion loan programme.

“I am confirming that the MEFP draft has been received by us at 9am today,” he said.

The draft MEFP is a prerequisite to pave the way towards striking a staff-level agreement. It may be considered as the crux of decisions negotiated between Pakistan and the Fund because it includes policy actions and structural benchmarks the two sides agreed on.

Virtual meeting with IMF on Monday

After his confirmation that Pakistan had received the MEFP draft, minister Dar said a virtual meeting will now be held with the Washington-based lender to take things forward.

"The government and its economic team are struggling to finalise the deal with the IMF," he said.

At the start of his media talk, the finance minister gave a reminder that the government is implementing a programme signed by former prime minister Imran Khan with the IMF in 2019-2020. He reiterated that the Shehbaz Sharif-led government is holding talks on this agreement as a "sovereign commitment".

"This is an old agreement which had been suspended and delayed previously," he noted.

Moving to Pakistan's talks with the IMF mission, the finance minister said that the 10-day-long discussions were extensive and covered the power and gas sectors and the fiscal and monetary side.

"The SBP governor and officials from different departments and ministries participated in the talks," said Dar.

Focusing on minimising untargeted subsidies: Dar

The finance minister announced that new taxes worth Rs170 billion will be imposed and energy sector reforms will be implemented to restore the loan facility. He also added that the government was focusing on "minimising untargeted subsidies".

He opposed rumours of taxation measures worth Rs700-800 billion.

The finance minister said that some of the reforms suggested by the IMF are in Pakistan's favour.

Dar emphasised that reforms are needed in Pakistan, adding that the premier has assured the IMF that the government would implement them.

Reforms in the energy sector will be implemented and the main thrust of it is to check the flow of the circular debt, he said, adding that the circular debt in the gas sector will be brought to zero while untargeted subsidies will be minimised.

Economy is bleeding: finmin

We believe that there are some sectors that need to be reformed in Pakistan's interest, he said.

The finmin said that the economy is bleeding and blamed those who misgoverned and mishandled it, leading to economic devastation. He urged that it needs to be fixed.

Talking about the power sector, Dar said that Rs3,000 billion is spent on electricity generation but its recovery is just Rs1,800 billion.

"Even though these reforms are painful, we will have to implement them," he maintained. He said that the government had decided that Pakistan will complete the IMF's programme for the second time.

“Pakistan will get $1.2 billion after approval of the IMF’s Executive Board.”

He said it has been decided to increase the budget of the Benazir Income Support Program (BISP) by Rs40 to Rs400 billion in order to reduce the burden of inflation on the most vulnerable segments of society.

On depleting forex reserves

On the depleting forex reserves, the minister assured that they will be boosted. He said that the State Bank of Pakistan (SBP) is managing it, adding that there are some commitments made by friendly countries.

"Pakistan had made big payments to countries during this time, and once the programme is finalised, we will get the amount back," said Dar.

Dar blamed the previous government for the credibility gap, saying that the IMF doesn't trust Pakistan as not only did the country fail to implement the reforms, but it reversed them at the time of the no-confidence motion.

"This has negatively portrayed Pakistan's image and this has affected the recent talks as [the IMF] is not sure if we would agree to it," he added.

He added that the government refused to impose sales tax on petrol and the IMF conceded it. "It was mutually agreed that there will be no sales tax on petroleum products," he said. He added that the general sales taxes will be added to the Rs170 billion.

Dar said that the Rs170 billion in taxes will have to be recovered within four months in this fiscal year.

What did the IMF say?

In his brief statement, IMF mission chief Nathan Porter said that “virtual discussions” will continue between the two sides in the coming days to finalise the “implementation details” of the policies.

Porter said timely and decisive implementation of policy measures along with resolute financial support from official partners are critical for Pakistan to successfully regain macroeconomic stability and advance its sustainable development.

The statement welcomed Prime Minister Shehbaz Sharif’s commitment to implement policies that are required to “safeguard macroeconomic stability”.

He also thanked the authorities for taking part in “constructive discussions”.

Porter noted that “considerable progress” was made during the talks with Pakistani officials on policy measures to address domestic and external imbalances.

The IMF mission chief highlighted that the “key priorities include strengthening the fiscal position with permanent revenue measures and reduction in untargeted subsidies, while scaling up social protection to help the most vulnerable and those affected by the floods; allowing the exchange rate to be market determined to gradually eliminate the foreign exchange shortage; and enhancing energy provision by preventing further accumulation of circular debt and ensuring the viability of the energy sector”.

Economic woes of crisis-stricken Pakistan

Pakistan’s foreign exchange reserves held by the central bank decreased by 5.5% or $170 million to $2.91 billion in the week ending February 3, the State Bank of Pakistan said on Thursday, deepening the economic woes of the crisis-stricken country.

The country has $8.54 billion in reserves in total, including $5.62 billion held by commercial banks.

The country is struggling to service extremely high levels of external debt, and has barely enough dollars to cover less than three weeks worth of imports.

The nation’s already precarious economic predicament was made worse by the rapidly decreasing reserves. Pakistan's talks with the IMF to obtain assistance for containing a growing financial crisis was made worse by a lack of foreign currency and skyrocketing inflation.

The rupee recently fell to historic lows after the government, in an attempt to meet IMF lending conditions, lifted currency controls that had been artificially supporting the currency.

Pakistan is dealing with a serious array of issues. Tens of millions of people were harmed by flooding last year, which cost $30 billion in damages. The country has been negatively impacted by inflation, the impact of Russia’s war in Ukraine on food and energy prices and political uncertainty, of course.

Pakistan has long-standing issues with its balance of payments. The government is hoping that it will quickly reach an agreement with the IMF mission over the terms of its $6.5 billion lending programme to unlock crucial funding from the IMF this time. But even if a loan tranche of $1 billion is unfrozen, this is only a bandage. More amounts are required if Pakistan is to avoid default.

Economists agree that debt restructuring or reprofiling is essential for the country to avert default.

Pakistan’s existing debt mostly consists of public debt to bilateral countries and multilateral institutions like the World Bank, IMF, Asian Development Bank, and Islamic Development Bank.

-

Will Warner Bros finalize deal with Paramount or stays loyal with Netflix's offer?

-

$44 billion Bitcoin blunder: Bithumb exchange apologizes for accidental payout

-

Global memory chip crunch puts spotlight on Apple; Will iPhone become more pricey?

-

Bitcoin plummets toward $60,000 as investors dump risky bets

-

Bitcoin crashes below $63K as regulatory pressure and market fears grow

-

Bitwise Crypto Industry innovators ETF: What investors should do in 2026?

-

Nintendo shares slide again as momentum fears grow

-

Gold, silver prices fallen sharply; What’s driving the drop?