Who is India's Adani and why is his company tanking?

Adani's personal wealth dived by around $40bn and he has tumbled down the real-time Forbes rich list to number eight

The business empire of Gautam Adani has shed tens of billions of dollars in value on the back of a report alleging accounting fraud that the Indian tycoon's firm has strenuously rejected.

Who is Gautam Adani?

Adani, 60, is a publicity-shy school dropout of humble origins who rose to become the world's third-richest man with a fortune — until last week — of around $130 billion.

Moving to Mumbai in his teens to work sorting diamonds, he formed his own import-export business. His big break came in 1995 when he acquired a shipping port just as India's economy was opening up.

What does his empire do?

Today Adani Group does everything from power generation and coal mining to cement, media and food. Its seven listed units had a market value in January of around $220 billion.

Critics say Adani's closeness to Prime Minister Narendra Modi, a fellow native of Gujarat state, has brought his group an unfair advantage in winning business.

On the back of eye-watering rises in the share prices of his firms, Adani became Asia's richest man. Globally only Elon Musk and Bernard Arnault and family were wealthier, according to Forbes.

What has been alleged?

On January 24, Hindenburg Research — an activist US investment group that bets on stocks falling — accused Adani Group of committing "a brazen stock manipulation and accounting fraud scheme over the course of decades".

Hindenburg's two-year investigation also found that elder brother Vinod Adani, "through several close associates, manages a vast labyrinth of offshore shell entities".

"We believe the Adani Group has been able to operate a large, flagrant fraud in broad daylight in large part because investors, journalists, citizens and even politicians have been afraid to speak out for fear of reprisal," it said.

What has been the result?

The report has sparked a huge sell-off in shares in Adani's firms, wiping out more than $68 billion in market value, according to Bloomberg News. Trading in some stocks was temporarily halted.

Adani's personal wealth has dived by around $40 billion and he has tumbled down the real-time Forbes rich list to number eight.

The timing was also terrible, coming just as Adani Group is seeking to raise $2.5 billion to strengthen its finances with a sale of shares that is due to expire on Tuesday.

How has Adani reacted?

On January 25, Adani´s finance chief called the Hindenburg report a "malicious combination of selective misinformation and stale, baseless and discredited allegations that have been tested and rejected by India´s highest courts".

On Sunday the firm issued a 413-page statement that it said rebutted all of Hindenburg's claims, calling the group the "Madoffs of Manhattan" — a reference to crooked financier Bernie Madoff.

"This is not merely an unwarranted attack on any specific company but a calculated attack on India, the independence, integrity and quality of Indian institutions, and the growth story and ambition of India," it said.

Did this reassure investors?

Some of Adani´s firms inched back upwards on Monday, but on the whole, investors continued to dump Adani stock, wiping off billions more in market value.

Hindenburg said that only about 30 pages of the Adani statement focused on issues related to its report.

"The remainder of the response consisted of 330 pages of court records, along with 53 pages of high-level financials, general information, and details on irrelevant corporate initiatives, such as how it encourages female entrepreneurship and the production of safe vegetables," it said.

-

'Harry Potter' star Rupert Grint shares where he stands politically

-

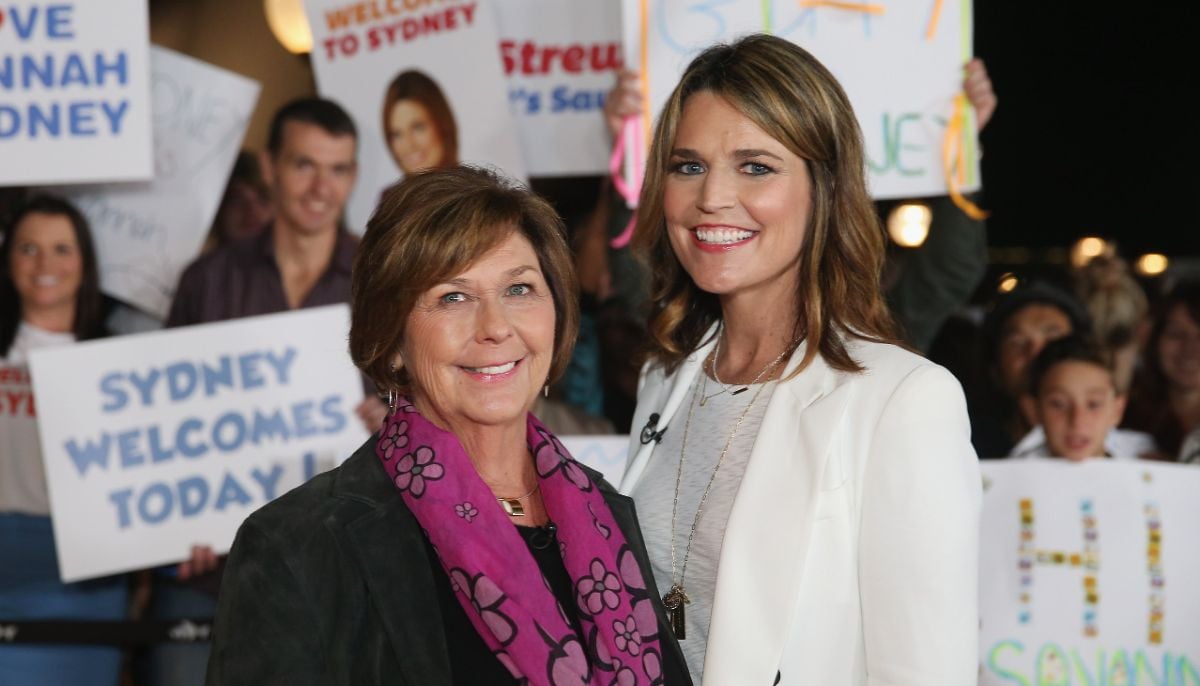

Drama outside Nancy Guthrie's home unfolds described as 'circus'

-

Marco Rubio sends message of unity to Europe

-

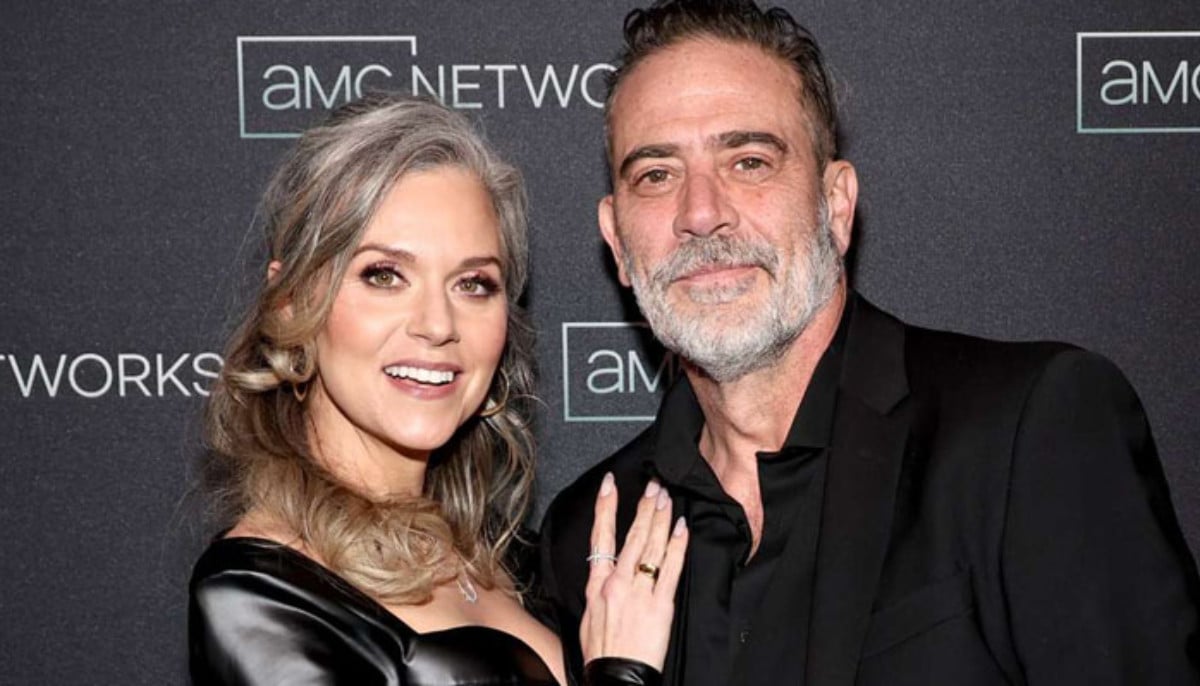

Hilarie Burton reveals Valentine's Day plans with Jeffrey Dean Morgan

-

Jacob Elordi, Margot Robbie on 'devastating' scene in 'Wuthering Heights'

-

China to implement zero tariffs on African imports in major trade shift

-

Jack Thorne explains hidden similarities between 'Lord of the Flies' and 'Adolescence'

-

Elon Musk vs Reid Hoffman: Epstein files fuel public spat between tech billionaires