Rupee rout enters second day as free-float toll deepens

Rupee closes at Rs262.60 compared to Thursday's close of Rs255.43 in interbank market

Pakistan's rupee piled up more losses Friday as it shed over Rs7 or 2.73% against the US dollar as forex companies removed a cap on the exchange rate, a move slated to pave the way for the government to win a much-needed loan tranche from the International Monetary Fund (IMF).

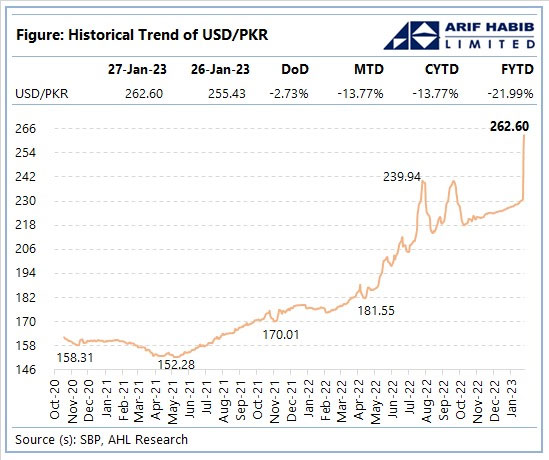

The local unit closed at Rs262.60 compared to Thursday's close of Rs255.43 in the interbank market, data released by the State Bank of Pakistan (SBP) showed.

The greenback has gained Rs31.28 in the interbank market since Thursday as forex companies removed a cap on the exchange rate — a key demand of the IMF as part of a bailout programme agreed upon in 2018.

Pakistan is drastically short on forex reserves owing to persistently rising demand for the dollar as the foreign exchange reserves held by the State Bank of Pakistan further nosedived to $3.6 billion as of January 20, 2023, after witnessing a decline in reserves by $923 million owing to external debt repayments.

The rupee fell to 269 to the dollar in the open market, a decline of Rs3 compared to the day before, according to the rates provided by the Exchange Companies Association of Pakistan (ECAP).

A day earlier, the rupee shed 24.11 in the interbank market, falling as low as 255.43 rupees to the dollar. The 9.6% decline is the second-biggest drop in a single session.

The previous low of 239.94 rupees was recorded on July 28, 2022, when Pakistan´s long-struggling economy was further weakened by political chaos and devastating floods.

In 2019, the government of former prime minister Imran Khan brokered a multi-billion-dollar loan package from the lender of the last resort.

But the economy slid backwards when Khan reneged on his promise to cut subsidies and market interventions that had cushioned the cost-of-living crisis.

Prime Minister Shehbaz Sharif, who ousted Khan in a no-confidence vote last spring, has also been reluctant to meet loan conditions amid falling popularity.

Exchange Companies Association of Pakistan President Zafar Paracha told AFP the cap was lifted on Wednesday "in consultation with the state bank".

— Addition input from AFP

-

Bitcoin crashes below $63K as regulatory pressure and market fears grow

-

Bitwise Crypto Industry innovators ETF: What investors should do in 2026?

-

Nintendo shares slide again as momentum fears grow

-

Gold, silver prices fallen sharply; What’s driving the drop?

-

Gold’s record climb: Experts question if its safety is ‘overstated’

-

Dubai unveils plans to construct street built with real gold

-

Netflix slams Paramount’s bid: 'Doesn't pass sniff test’ as Warner battle escalates

-

Ubisoft: Shares plunge amid restructuring plan and wave of games cancellations