Remittances down 19% in Dec as illegal channels weigh

Remittances decline 11% to $14.052 billion in the first half of FY23, says SBP

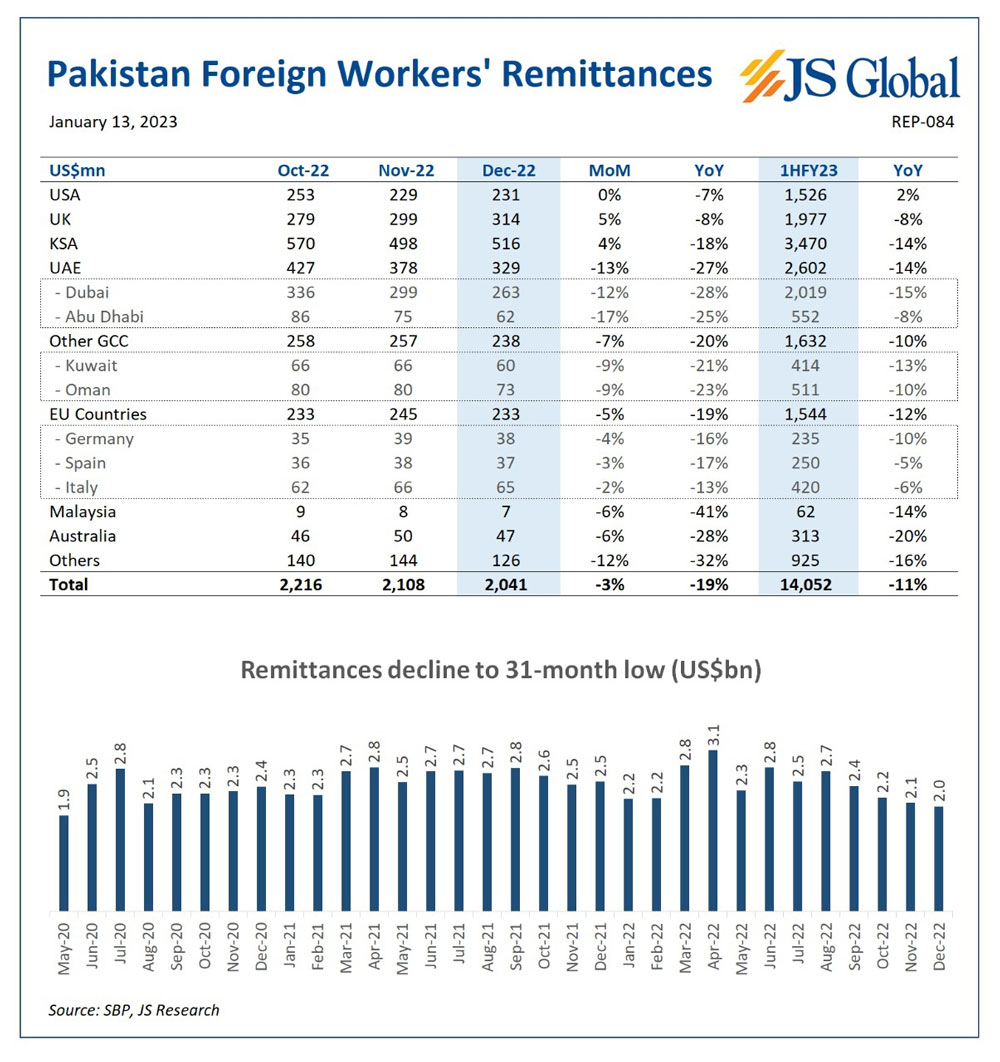

KARACHI: Remittances sent home by overseas Pakistani workers fell 19% to $2 billion in December 2022 compared to $2.52 billion in the same month of 2021, latest numbers showed Friday, which analysts attributed to a rise of unofficial money-transfer channels and world economic slowdown.

The remittances received during the July-December period of FY23 fell 11% to $14.052 billion from $15.807 billion in the first half of FY22, the State Bank of Pakistan (SBP) said.

Month-on-month, the inflows sent home by the Pakistani diaspora working abroad decreased by 3.2% to $ 2.108 billion in November 2022.

Arif Habib Limited (AHL), in a recent note, said a key risk that had emerged in the current account in recent months was the deteriorating trend in remittances.

The brokerage said that a sizeable gap (10-12%) between the official and unofficial exchange rates amid administrative measures undertaken by the SBP was the major reason for the declining official remittances trend, with rising flows via unofficial channels.

"We believe such a large gap between the two rates is unsustainable and counterproductive to the successful negotiations on the 9th review, which is a likely catalyst for things to normalize in the exchange markets."

The AHL report added that this trend was also evident from the sharp decline in official remittances. "We estimate, the country losing around USD 150-200mn monthly flows due to the artificial gap in official and unofficial rates of dollar," the brokerage said.

Remittances from Saudi Arabia, despite being the largest contributor, fell 18% to $516.3 million in December 2022 compared to $626.8 million sent in the same month of the previous year.

Inflows from the United Arab Emirates (UAE) declined 27% to $328.7 million from $453.2 million in December 2021, according to the central bank.

Pakistan’s central bank forex reserves have plunged to the lowest level since February 2014 after a decline of 22.11%, posing a serious challenge for the country in financing imports.

The announcement came at a time when the country is in dire need of foreign aid to reduce its current account deficit as well as ensure enough reserves to meet its debt obligations.

Coupled with another $5.8 billion held by commercial banks, the nation has $10.2 billion in reserves — which barely covers three weeks of imports.

-

Bitwise Crypto Industry innovators ETF: What investors should do in 2026?

-

Nintendo shares slide again as momentum fears grow

-

Gold, silver prices fallen sharply; What’s driving the drop?

-

Gold’s record climb: Experts question if its safety is ‘overstated’

-

Dubai unveils plans to construct street built with real gold

-

Netflix slams Paramount’s bid: 'Doesn't pass sniff test’ as Warner battle escalates

-

Ubisoft: Shares plunge amid restructuring plan and wave of games cancellations

-

Netflix revises Warner Bros. deal to $83 billion: All-cash offer