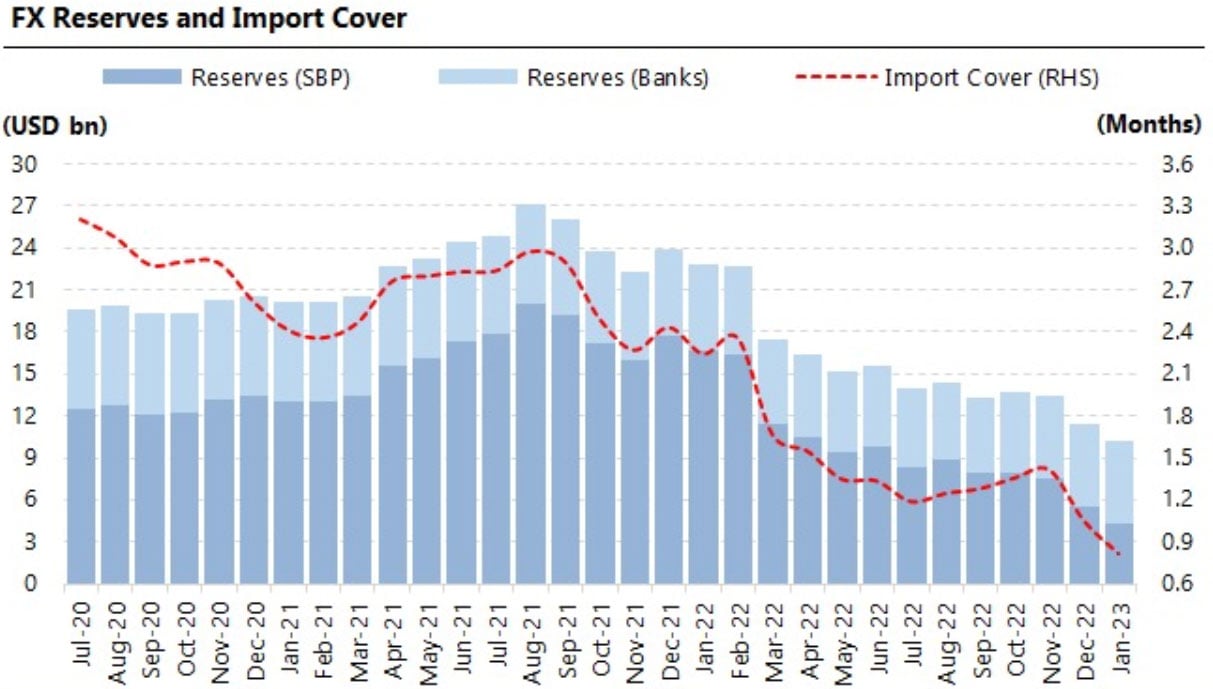

SBP foreign exchange reserves fall to near nine-year low

Reserves, which hit their lowest level since February 2014, will now only provide import cover worth 0.82 months

The State Bank of Pakistan-held (SBP) foreign exchange reserves plummet to a near nine-year low as the cash-strapped nation made external debt repayments.

The central bank released weekly data showing a decline of over 22% posing a serious challenge for the country in financing imports as Pakistan is in dire need of foreign aid to reduce its current account deficit as well as ensure enough reserves to pay its debt obligations for the ongoing financial year.

During the week ended on January 6, the central bank's forex reserves fell $1,233 million, or 22.12% to $4,343.2 million, a statement from the central bank said, down from last week's reserves of $5,576.5 million.

Coupled with another $5.8 billion held by commercial banks, the nation has $10.2 billion in reserves — enough to pay for just three weeks of imports.

The reserves, which hit their lowest level since February 2014, will now only provide import cover worth 0.82 months, as the country tries to lessen imports amid a greenback shortage.

Last week, Federal Minister for Finance and Revenue Senator Ishaq Dar said that Pakistan's foreign exchange reserves would "strengthen" in the coming days as he banked on friendly countries for inflows.

The central bank mentioned that the country repaid $1,233 million in external debt. This repayment has been reflected in the data released today.

The reserve position is expected to stabilise in the upcoming days as the United Arab Emirates (UAE) today agreed to roll over the existing loan of $2 billion and provide an additional $1 billion loan.

Meanwhile, the country, with a $350 billion economy, also inked an agreement with Saudi Arabia to finance oil derivatives worth $1 billion which will also aid the dwindling reserves

On January 9, Pakistan managed to secure pledges worth $9.7 billion at the one-day International Conference on Climate Resilient Pakistan in Geneva which is expected to materialise within three years.

The government is also eyeing to pass the ninth review of the International Monetary Fund (IMF) to secure a $1.1 billion bailout package, but both sides have made no substantial headway in recent days.

-

Will Warner Bros finalize deal with Paramount or stays loyal with Netflix's offer?

-

$44 billion Bitcoin blunder: Bithumb exchange apologizes for accidental payout

-

Global memory chip crunch puts spotlight on Apple; Will iPhone become more pricey?

-

Bitcoin plummets toward $60,000 as investors dump risky bets

-

Bitcoin crashes below $63K as regulatory pressure and market fears grow

-

Bitwise Crypto Industry innovators ETF: What investors should do in 2026?

-

Nintendo shares slide again as momentum fears grow

-

Gold, silver prices fallen sharply; What’s driving the drop?