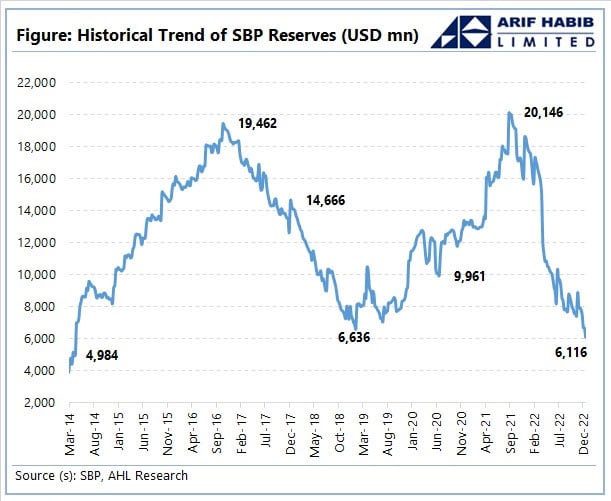

SBP forex reserves fall to level less than 40 days of imports

Forex reserves held by SBP clock in at $6,116.2m after a decline of $584m during the week ended Dec 16

The foreign exchange reserves held by the State Bank of Pakistan (SBP) plunged over $500 million to their lowest level since April 2014 during the week that ended on December 16, the central bank said on Thursday.

The central bank, in its weekly statement, said the foreign currency reserves held by the SBP were recorded at $6,116.2 million during the week under review, down $584 million compared with $6,700 on December 9.

Net reserves held by banks amounted to $5,883.9 million. The central bank cited external debt repayments as a major reason behind this decline.

Overall liquid foreign currency reserves held by the country — including net reserves held by banks other than the SBP — stood at $12,000.1 million.

The drop means the reserves have fallen further from last week's barely 1.5 months of import cover, even as it battles decades of high inflation and scrambles to secure International Monetary Fund (IMF) funds.

Pakistan has recently been battling to stave off a balance of payments pressures due to dwindling foreign currency reserves and a widening current account deficit.

The lack of foreign assistance amid delay in the revival of the IMF programme in the presence of a higher trade deficit and increasing foreign debt payments put a heavy dent in the reserves.

The ninth-review talks have been delayed apparently due to Fund’s criticism over an increased fiscal deficit.

The government is unwilling to impose more taxes for higher revenues, while the IMF insists the government must consolidate the economy.

Moreover, Pakistan's rupee has shed nearly 26% since the start of the year, hitting its weakest level on record in September, due to falling reserves and the higher import bill.

-

$44 billion Bitcoin blunder: Bithumb exchange apologizes for accidental payout

-

Global memory chip crunch puts spotlight on Apple; Will iPhone become more pricey?

-

Bitcoin plummets toward $60,000 as investors dump risky bets

-

Bitcoin crashes below $63K as regulatory pressure and market fears grow

-

Bitwise Crypto Industry innovators ETF: What investors should do in 2026?

-

Nintendo shares slide again as momentum fears grow

-

Gold, silver prices fallen sharply; What’s driving the drop?

-

Gold’s record climb: Experts question if its safety is ‘overstated’