PSX sinks below 40,000 as stocks plunge to lowest level since July 2022

KSE-100 closes at 39,935 points, bears hold their grip over the market as investors offload their holdings in panic

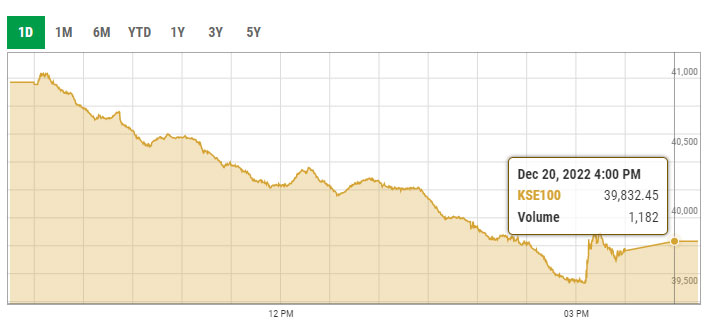

The Pakistan Stock Exchange (PSX) on Tuesday sunk below the 40,000 mark — its lowest level since July 2022 — as the benchmark KSE-100 index fell over 1,100 points owing to emerging political developments.

The bears held their grip over the market throughout the day, as investors were seen offloading their holdings in panic.

Jittery players reacted negatively after the Pakistan Muslim League-Nawaz (PML-N) and the Pakistan Peoples Party (PPP) submitted a no-confidence motion against Chief Minister Parvez Elahi in the Punjab Assembly last night.

Across-the-board profit selling was witnessed during the session as the prevailing political instability-led economic crisis in the country kept the market environment tense.

Depleting foreign exchange reserves, continuously falling rupee against the US dollar besides delay in the ninth review of the International Monetary Fund (IMF) programme haunted the domestic bourse, keeping the bulls at bay.

Earlier, the session commenced on a negative note, as the KSE-100 index nosedived to an intra-day low of 39,533.03 points.

Moving forward, the index hovered around that level, as market participants failed to find any positive triggers throughout the day, and it settled below the psychological barrier of 40,000 points for the first time since July 2022.

Moreover, mutual funds’ redemptions at year-end and worsening economic indicators also added fuel to the downtrend.

At close, the benchmark KSE-100 index plunged by 1,138.37 points, to -2.78%, to settle at 39,832.45.

Speaking to Geo.tv, AA Commodities Director Adnan Agar said the stock market is reacting to all "bad political news".

"Players are looking for political stability before assuming fresh positions in the market," he said, adding that any positive news on the political front or positive development regarding IMF programme will reinstate investors' confidence.

Pakistan and the global lender have been holding discussions with Islamabad on the ninth review "productive". However, differences between both sides still persist making consensus harder to strike on a staff-level agreement for the completion of the 9th review under the $7 billion Extended Fund Facility (EFF).

Agar further highlighted that market players are also concerned about the future of the Shehbaz Sharif-led coalition government while taking into account the current political developments.

The federal government has been thrown off guard after Imran Khan announced that he will be dissolving the Punjab and Khyber Pakhtunkhwa assemblies this week.

"Moreover, constant depreciation of the rupee against the US dollar is adding fuel to the downtrend," he said, mentioning that the investors are unhappy with how Finance Minister Ishaq Dar is handling the rupee-dollar parity.

Shares of 341 companies were traded during the session. At the close of trading, 37 scrips closed in the green, 283 in the red, and 21 remained unchanged.

Overall trading volumes rose to 265.28 million shares compared with Monday's tally of 142.57 million. The value of shares traded during the day was Rs6.53 billion.

WorldCall Telecom Limited was the volume leader with 12.52 million shares traded, losing Rs0.06 to close at Rs1.17. It was followed by K-Electric with 19.97 million shares traded, losing Rs0.17 to close at Rs2.29 and Hascol Petrol with 12.52 million shares losing Rs0.83 to close at Rs5.26.

-

Will Warner Bros finalize deal with Paramount or stays loyal with Netflix's offer?

-

$44 billion Bitcoin blunder: Bithumb exchange apologizes for accidental payout

-

Global memory chip crunch puts spotlight on Apple; Will iPhone become more pricey?

-

Bitcoin plummets toward $60,000 as investors dump risky bets

-

Bitcoin crashes below $63K as regulatory pressure and market fears grow

-

Bitwise Crypto Industry innovators ETF: What investors should do in 2026?

-

Nintendo shares slide again as momentum fears grow

-

Gold, silver prices fallen sharply; What’s driving the drop?