Stocks end flat amid mini-budget speculations

Stocks on Tuesday walked a tight rope between green and red to end flat as investors remained on guard ahead of the government’s decision of jacking power prices, amid mini-budget speculations and macroeconomic concerns that led to selling pressure in select sectors, dealers said.

The Economic Coordination Committee (ECC), which met today (Tuesday) under the chair of Finance Minister Asad Umar, deferred the power tariff hike decision till next meeting, which is likely to be held next week. The meeting was expected to approve an increase of Rs1.50 to Rs2/unit in electricity tariff. Topline securities in its daily market review said worsening macros continued to weigh on investors’ sentiments as the government was yet to take concrete measures to contain depleting foreign exchange reserves.

Ahsan Mehanti, an analyst at Arif Habib Corporation, said sentiments remained upbeat on speculations amid upbeat mini budget last week and downward revision of fiscal deficit target for FY19.

“Surge in global oil prices supported oil stocks, while auto, steel and cement sectors outperformed on strong earnings’ outlook after amended finance bill 2018 favoured continuation of CPEC (China-Pakistan Economic Corridor) projects, reversal of petroleum development levy, and removal of restrictions on non-filers, a move that is likely to attract investment in real estate sector,” Mehanti added.

Pakistan Stock Exchange’s (PSX) benchmark KSE-100 shares index rose 0.08 percent or 31.75 points to close at 41,036.30 points, while its KSE-30 shares index edged up 0.25 percent or 49.54 points to end at 20,016.02 points.

Out of 367 active scrips, 141 moved up, 206 retreated, and 20 remained unchanged. The ready market volumes stood at 101.660 billion shares as compared to the turnover of 98.621 million shares in the previous session.

The market remained under selling pressure owing to widespread selling witnessed in auto sector where shares recorded decline under the lead of Ghandhara dropping by Rs11.58/share, while minimum fall was recorded in Indus Motor, which slipped by Rs2.20/share. Moreover, the market was rife with the news that the government might re-impose the restriction on non-filers barring them from buying new vehicles. In the mini-budget, presented recently, the government had removed the restriction on non-filers allowing them to buy vehicles and property in excess of Rs4 million.

The highest gainers were Island Textile, up Rs77.31 to close at Rs1627.00/share, and Nestle Pakistan, up Rs64.00, to finish at Rs9499.00/share.

Companies that booked highest losses were Pakistan Tobacco, down Rs119.94 to close at Rs2279.06/share, and Millat Tractors, down Rs25.35, to close at Rs1062.36/share. Unity Foods Limited recorded the highest volumes with a turnover of 9.412 million shares. The scrip gained Rs0.27 to close at Rs35.90/share. It was followed by Lotte Chemical with a turnover of 3.858 million shares, whereas the scrip gained Rs0.16 to close at Rs3.858/share. The lowest volumes were witnessed in TRG Pakistan Limited, recording a turnover of 5.440 million shares, the scrip lost Rs0.61 to end at Rs28.43/share.

-

Netflix, Paramount Shares Surge Following Resolution Of Warner Bros Bidding War

Netflix, Paramount Shares Surge Following Resolution Of Warner Bros Bidding War -

Bling Empire's Most Beloved Couple Parts Ways Months After Announcing Engagement

Bling Empire's Most Beloved Couple Parts Ways Months After Announcing Engagement -

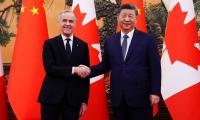

China-Canada Trade Breakthrough: Beijing Eases Agriculture Tariffs After Mark Carney Visit

China-Canada Trade Breakthrough: Beijing Eases Agriculture Tariffs After Mark Carney Visit -

London To Host OpenAI’s Biggest International AI Research Hub

London To Host OpenAI’s Biggest International AI Research Hub -

Elon Musk Slams Anthropic As ‘hater Of Western Civilization’ Over Pentagon AI Military Snub

Elon Musk Slams Anthropic As ‘hater Of Western Civilization’ Over Pentagon AI Military Snub -

Walmart Chief Warns US Risks Falling Behind China In AI Training

Walmart Chief Warns US Risks Falling Behind China In AI Training -

Wyatt Russell's Surprising Relationship With Kurt Russell Comes To Light

Wyatt Russell's Surprising Relationship With Kurt Russell Comes To Light -

Elon Musk’s XAI Co-founder Toby Pohlen Steps Down After Three Years Amid IPO Push

Elon Musk’s XAI Co-founder Toby Pohlen Steps Down After Three Years Amid IPO Push -

Is Human Mission To Mars Possible In 10 Years? Jared Isaacman Breaks It Down

Is Human Mission To Mars Possible In 10 Years? Jared Isaacman Breaks It Down -

‘Stranger Things’ Star Gaten Matarazzo Reveals How Cleidocranial Dysplasia Affected His Career

‘Stranger Things’ Star Gaten Matarazzo Reveals How Cleidocranial Dysplasia Affected His Career -

Google, OpenAI Employees Call For Military AI Restrictions As Anthropic Rejects Pentagon Offer

Google, OpenAI Employees Call For Military AI Restrictions As Anthropic Rejects Pentagon Offer -

Peter Frampton Details 'life-changing- Battle With Inclusion Body Myositis

Peter Frampton Details 'life-changing- Battle With Inclusion Body Myositis -

Waymo And Tesla Cars Rely On Remote Human Operators, Not Just AI

Waymo And Tesla Cars Rely On Remote Human Operators, Not Just AI -

AI And Nuclear War: 95 Percent Of Simulated Scenarios End In Escalation, Study Finds

AI And Nuclear War: 95 Percent Of Simulated Scenarios End In Escalation, Study Finds -

David Hockney’s First English Landscape Painting Heads To Sotheby’s Auction; First Sale In Nearly 30 Years

David Hockney’s First English Landscape Painting Heads To Sotheby’s Auction; First Sale In Nearly 30 Years -

How Does Sia Manage 'invisible Pain' From Ehlers-Danlos Syndrome

How Does Sia Manage 'invisible Pain' From Ehlers-Danlos Syndrome