FBR acts against 270,000 non-filers of returns

KARACHI: The Federal Board of Revenue (FBR) has initiated legal actions against at least 270,000 taxpayers who couldn’t file returns for the tax year 2019 despite being enrolled in the previous tax year, sources said on Monday.

The sources said tax authorities are sending notices to individuals and companies that filed returns and declaration of assets for tax year 2018, but failed to comply with the obligation in the subsequent year. The sources said the action began after expiry of due date for filing of tax returns, which was February 28, 2020.

The sources at Regional Tax Office (RTO) Karachi said the tax office started issuing notices, giving an opportunity to non-filers to ensure compliance along with payment of late filing. “In case person/company deliberately defaults then penal provisions may be invoked,” an official at the RTO Karachi said.

The official said if an individual deliberately does not comply with the notice for filing returns, then the individuals would be liable to fine or a one year imprisonment. The latest active taxpayers list (ATL) revealed that around 2.53 million individuals and companies filed annual returns for the tax year 2019. The ATL showed number of returns filed up to February 29. Meanwhile, the estimated number of returns filing for the tax year 2018 increased to a record high of over 2.8 million, showing a gap of around 270,000 returns, compared to the number for the tax year 2019.

However, the latest returns filing increased 58 percent, compared to 1.6 million returns filed till February 28, 2019. Under a section (114) of Income Tax Ordinance, 2001, the FBR explained the mandatory requirement of returns filing on certain classes of individuals and companies.

Under the law, every company registered with the Securities and Exchange Commission of Pakistan (SECP) is required to file returns. But, the FBR received around 40,988 corporate returns for the tax year 2019. On the other hand, the SECP registered around 100,000 companies till June 30, 2019. This shows that around 59 percent corporate entities failed to comply with the mandatory requirement.

FBR on Saturday last said it received 2.34 million returns from salaried and business individuals, while the association of individuals filed another 62,403 returns.

“If an individual, under the tax ordinance, fails to file returns of income by due date then such individual is required to pay a penalty equal to 0.1 percent of the tax payable in respect of that tax year for each day of default,” the law said.

“(This is) subject to a maximum penalty of 50 percent of the tax payable provided that if the penalty worked out as aforesaid is less than forty thousand rupees or no tax is payable for that tax year such person shall pay a penalty of forty thousand rupees.”

-

Netflix, Paramount Shares Surge Following Resolution Of Warner Bros Bidding War

Netflix, Paramount Shares Surge Following Resolution Of Warner Bros Bidding War -

Bling Empire's Most Beloved Couple Parts Ways Months After Announcing Engagement

Bling Empire's Most Beloved Couple Parts Ways Months After Announcing Engagement -

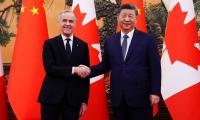

China-Canada Trade Breakthrough: Beijing Eases Agriculture Tariffs After Mark Carney Visit

China-Canada Trade Breakthrough: Beijing Eases Agriculture Tariffs After Mark Carney Visit -

London To Host OpenAI’s Biggest International AI Research Hub

London To Host OpenAI’s Biggest International AI Research Hub -

Elon Musk Slams Anthropic As ‘hater Of Western Civilization’ Over Pentagon AI Military Snub

Elon Musk Slams Anthropic As ‘hater Of Western Civilization’ Over Pentagon AI Military Snub -

Walmart Chief Warns US Risks Falling Behind China In AI Training

Walmart Chief Warns US Risks Falling Behind China In AI Training -

Wyatt Russell's Surprising Relationship With Kurt Russell Comes To Light

Wyatt Russell's Surprising Relationship With Kurt Russell Comes To Light -

Elon Musk’s XAI Co-founder Toby Pohlen Steps Down After Three Years Amid IPO Push

Elon Musk’s XAI Co-founder Toby Pohlen Steps Down After Three Years Amid IPO Push -

Is Human Mission To Mars Possible In 10 Years? Jared Isaacman Breaks It Down

Is Human Mission To Mars Possible In 10 Years? Jared Isaacman Breaks It Down -

‘Stranger Things’ Star Gaten Matarazzo Reveals How Cleidocranial Dysplasia Affected His Career

‘Stranger Things’ Star Gaten Matarazzo Reveals How Cleidocranial Dysplasia Affected His Career -

Google, OpenAI Employees Call For Military AI Restrictions As Anthropic Rejects Pentagon Offer

Google, OpenAI Employees Call For Military AI Restrictions As Anthropic Rejects Pentagon Offer -

Peter Frampton Details 'life-changing- Battle With Inclusion Body Myositis

Peter Frampton Details 'life-changing- Battle With Inclusion Body Myositis -

Waymo And Tesla Cars Rely On Remote Human Operators, Not Just AI

Waymo And Tesla Cars Rely On Remote Human Operators, Not Just AI -

AI And Nuclear War: 95 Percent Of Simulated Scenarios End In Escalation, Study Finds

AI And Nuclear War: 95 Percent Of Simulated Scenarios End In Escalation, Study Finds -

David Hockney’s First English Landscape Painting Heads To Sotheby’s Auction; First Sale In Nearly 30 Years

David Hockney’s First English Landscape Painting Heads To Sotheby’s Auction; First Sale In Nearly 30 Years -

How Does Sia Manage 'invisible Pain' From Ehlers-Danlos Syndrome

How Does Sia Manage 'invisible Pain' From Ehlers-Danlos Syndrome